The Federal Housing Administration’s investigation into possible appraisal inflations on reverse mortgage loans revealed an issue the agency decided it must address.

The Federal Housing Administration’s investigation into possible appraisal inflations on reverse mortgage loans revealed an issue the agency decided it must address.

On Friday, the FHA announced that it will require a second appraisal on select reverse mortgage loans that have been flagged by the agency as having the potential for an inflated property valuation. As part of the new guideline, which takes effect Oct. 1, 2018, lenders must submit their appraisals to FHA to undergo a collateral risk assessment.

In a call with reporters on Monday, the FHA revealed its reasons for making the changes.

The FHA told reporters that out of the 134,000 appraisals inputted into its automated valuation model, approximately 50,000 (37%) were inaccurate by at least 3%.

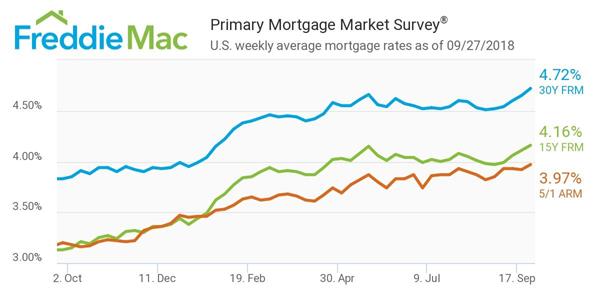

“We were trying to understand why, in a still relatively low interest rate market where house prices have returned in most major markets including in many of these states where reverse mortgages were, why were we still hemorrhaging money,” FHA Commissioner Brian Montgomery said. “We thought this was a contributing factor that required further due diligence.”

In regard to the assessment methods the agency will use to enact the new policy, FHA Deputy Assistant Secretary Gisele Roget said only that it will involve multiple review factors.

“The disclosure of the tools and the methodology could result in appraisals being adjusted to conform to these factors, and therefore to preserve the integrity of this new process, we are going to be treating the assessment methodology and the valuation tools as proprietary and confidential,” Roget said.

Roget said the impact on the origination timeline should be minimal, with the risk assessment taking no longer than three days once the lender uploads the appraisal into FHA Connection.

Roget also said FHA expects to fully automate the process by December 1st.

“In the interim, we will be using the FHA Resource Center to use case warnings to let our FHA reverse mortgage lenders know whether or not, following the collateral risk assessment, a second appraisal will be required,” she said.

When asked how many appraisals FHA expected to require a second look, Montgomery said it was hard to know. He said the agency used three separate models to evaluate the presence of appraisal inflation, and that all three revealed pronounced levels in 2008, 2009 and 2010.

“It’s hard to predict going forward, especially given the fact that it has come down significantly through the years, but since it’s not yet zero or close to zero, we felt it was prudent to issue this policy change at this time,” Montgomery said. “We will be monitoring it daily and we’ll certainly be reporting outage as we get more results.”

“One unique attribute also is that we’ll be able to follow these certainly by lender,” he continued, “so we’ll be looking at patterns, as some lenders are more outside the tolerance than others.”

Montgomery said putting an appraisal review process in place was the least disruptive of the potential HECM policy changes the agency considered. He also said the agency is looking at issuing another HECM program change soon, but he failed to elaborate on what this might entail.

In November, FHA will issue a report to Congress on the state of the reverse mortgage program and its impact on the Mutual Mortgage Insurance Fund, after a 2017 report revealed its negative net value of $14.5 billion. Changes made to the HECM program last October, which reduced principal limit factors and adjust mortgage insurance premiums, were designed to help tackle the issue, but Montgomery said it won’t solve the problem entirely.

“I can tell you that the changes FHA made to the principal limit factors and the adjustments to the HECM insurance premium we instated in 2017 were designed to help, but did not – and were not intended to – and will not fully solve the financial volatility of the program,” he said.

The latest guideline is yet another measure FHA is implementing to stop the bleeding.

The agency said it plans to work closely with lenders on implementation and acknowledges the guidelines may present some challenges for both lenders and FHA as the industry adapts.

Montgomery said it will monitor the process closely to determine its effectiveness.

“We want to make sure we reassess the efficacy of the program as we go along and see where we’ll be at the year-end mark and whether this is something we’ll continue or whether or not this is something that’s been beneficial,” he said.

Roget said implementing a valuation assessment is a forward step for the reverse industry.

“The use of collateral validation tools and is truly an industry best practice, and FHA using this in the reverse mortgage space is bringing FHA in line with the rest of the mortgage industry,” she said.

MCLEAN, Va., Sept. 24, 2018 (GLOBE NEWSWIRE) — Even with slightly improving inventory conditions and relenting home price pressures, home sales this year are now expected come in just below last year’s level, according to

MCLEAN, Va., Sept. 24, 2018 (GLOBE NEWSWIRE) — Even with slightly improving inventory conditions and relenting home price pressures, home sales this year are now expected come in just below last year’s level, according to  I just love this image and had to use it. It has been way too long since I used it in an actual post.

I just love this image and had to use it. It has been way too long since I used it in an actual post. New policy designed to reduce ‘appraisal inflation’

New policy designed to reduce ‘appraisal inflation’

California Gov. Jerry Brown on Sept. 29 signed SB 70, legislation that allows the state’s appraisers to name intended users other than a client in a restricted appraisal report.

California Gov. Jerry Brown on Sept. 29 signed SB 70, legislation that allows the state’s appraisers to name intended users other than a client in a restricted appraisal report.