| Vacancy No. | CERD237242277150HWF | Department | U.S. Army Corps of Engineers |

| Salary | $94,199.00 to $122,459.00 | Grade | 12 to 12 |

| Perm/Temp | Temporary | FT/PT | Full-time |

| Open Date | 12/19/2023 | Close Date | 1/5/2024 |

| Job Link | Apply Online | Who may apply | Public |

| Locations: | |||

| Baltimore, MD |

Appraiser Job in Baltimore, MD

posted in Appraiser News | Comments Off on Appraiser Job in Baltimore, MD

Appraisal Orders : Coming soon in 2024!

repost from: https://www.axios.com/2023/12/13/federal-reserve-interest-rates-meeting-decision

The Federal Reserve left interest rates unchanged at its final policy meeting of 2023, while signaling that 2024 could bring significant rate cuts.

Why it matters: The decision to leave rates unchanged in a 5.25% to 5.5% range for the third consecutive meeting. Officials indicated that the central bank is likely done with its historic rate-hiking campaign to tame inflation that has, so far, resulted in little damage to the economy.

- Officials have not ruled out raising rates again, but a tweak in its policy statement suggested rate hikes are done.

- During a press conference, Fed chair Jerome Powell also suggested as much, saying, “While we believe that our policy rate is likely at or near its peak for this tightening cycle, the economy has surprised forecasters.”

- Rate hikes “are not the base case anymore as it was 60, 90 days ago,” Powell said.

What’s new: Most top Fed officials envision cutting rates three or more times in 2024, according to new forecasts released Wednesday. The median projection was that in December of next year, the Fed’s target rate will be 4.6%, 0.75 percentage points lower than now.

- The median official envisions cutting rates by another full percentage point to 3.6% by year-end 2025.

What they’re saying: “Inflation has eased over the past year,” the Federal Open Market Committee said, in new language that acknowledges fading price pressures.

- The statement continued on to repeat language noting that inflation “remains elevated,” however.

The context: It comes as analysts and financial markets have increasingly prepared for the possibility of rate cuts early in 2024, which Powell pushed back on in a speech earlier this month.

- But at a press conference on Wednesday, Powell’s tone shifted. The Fed chair said there has been “real progress on inflation,” while the labor market has come more into balance.

- “These are the things we’ve been wanting to see,” Powell said. The natural next question, Powell said, is “when it will become appropriate to begin dialing back the amount of policy restraint that’s in place.”

Of note: Stocks jumped on the news of the prospective rate cuts next year. The S&P 500 rose by more than 1% and reached the highest level of the year.

- Meanwhile, bond yields dove lower: the 10-year bond yield fell by 16 basis points to 4.03% — continuing a sharp reversal after hitting 5% in late October.

Flashback: At its September meeting, the last time the Fed published formal forecasts, 12 of 19 top officials anticipated raising interest rates one more time this year. They elected not to do so in response to lower-than-expected inflation readings.

posted in Appraiser News | Comments Off on Appraisal Orders : Coming soon in 2024!

Happy Holidays!

I am whishing all my fellow appraisers happy holidays & a Merry Christmas! This is the slowest I have seen it during my career as an appraiser, so it can only get better from here! It will be a good time to really buckle down and focus on your non-lender work for 2024. The most work I see is for divorce, bankruptcy and date of death / estate appraisal services.

The best way to get those types of orders is through relationships with local attorneys in your area. First you have to reach them and then you have to keep them. Then you also need to get the work from the individuals that order your appraisal services directly. They will find you over the internet on service websites, apps and search engines. You have to focus on showing up on these locations, preferably near the top of the list.

Next year I will be working on getting more posts and marketing advice out on Appraiser Income as well as opening the Appraisers Club again to help appraisers get more of the Non-lender work that is out there. But in the meantime check all your social profiles, search for your ‘city name’ followed by appraiser / appraisal and see if you show up on the first page of google and see what you can do to get your company listed on any ‘service provider’ websites that do show up on the first page of the google results.

Happy Holidays and Merry Christmas!

~ Bryan

posted in Appraiser News | Comments Off on Happy Holidays!

HUD Appraiser – Job Baltimore, MD Boston, MA New York, NY

| Vacancy No. | 24-HUD-320-P | Department | Assistant Secretary for Housing-Federal Housing Commissioner |

| Salary | $110,798.00 to $149,651.00 | Grade | 13 to 13 |

| Perm/Temp | Permanent | FT/PT | Full-time |

| Open Date | 12/4/2023 | Close Date | 12/18/2023 |

| Job Link | Apply Online | Who may apply | Public |

| Locations: | |||

| Baltimore, MDBoston, MANew York, NY |

| Job Description (Please follow all instructions carefully) |

|---|

| Summary. This position is located at Department of Housing and Urban Development, Asst Secretary for Housing-Federal Housing Commissioner.This opportunity is also open to Status eligibles under announcement 24-HUD-319. Please refer to that announcement for details on open period, eligibility, and how to apply.This job is open toThe publicU.S. Citizens, Nationals or those who owe allegiance to the U.S.Clarification from the agencyU.S. citizens or U.S. Nationals; no prior Federal experience is required.This job is also open in another announcement to:Career transition (CTAP, ICTAP, RPL)Family of overseas employeesFederal employees – Competitive serviceIndividuals with disabilitiesLand & base managementMilitary spousesPeace Corps & AmeriCorps VistaSpecial authoritiesVeteransDutiesMaking a Difference: HUD’s Mission HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all. HUD is working to strengthen the housing market to bolster the economy and protect consumers; meet the need for quality affordable rental homes; utilize housing as a platform for improving quality of life; build inclusive and sustainable communities free from discrimination and transform the way HUD does business. As an Appraiser, you will:Furnish expert technical advice and guidance in appraisal matters, with respect to assigned programs, to field offices, contractors and program participants.Act as review appraiser for appraisals submitted through lenders doing business with the Department both under the MAP and TAP programs.Study and analyze the most difficult appraisal underwriting problems and recommends solutions for themRequirementsConditions of EmploymentCandidates will be selected for a job assigned to one of the official duty stations listed in this announcement. Failure to report to duty at the location for which the candidate is selected may be grounds for a disciplinary action, including removal.Key Requirements:Must be U.S. Citizen or U.S. National.A one year probationary period may be required.Must successfully complete a background investigation.Public Trust – Background Investigation will be required.Complete a Declaration for Federal Employment to determine your suitability for Federal employment, at the time requested by the agency.Have your salary sent to a financial institution of your choice by Direct Deposit/Electronic Funds Transfer.If you are a male applicant born after December 31, 1959, certify that you have registered with the Selective Service System or are exempt from having to do so.Go through a Personal Identity Verification (PIV) process that requires two forms of identification from the Form i-9. Federal law requires verification of the identity and employment eligibility of all new hires in the U.S.Obtain and use a Government-issued charge card for business-related travel.Please refer to “Additional Information Section for additional Conditions of Employment.”QualificationsYou must meet the following requirements by the closing date of this announcement. For the GS-13, you must have one year of experience at a level of difficulty and responsibility equivalent to the GS-12 grade level in the Federal service. Specialized Experience for this position is defined as: utilizing a wide range of range of appraisal concepts, principles, and practices to appraise, review, and analyze appraisals of multifamily properties such as: buildings with commercial space, condominium space or sites with environmental concerns. Examples of such experience may include:Interpreting and communicating laws, regulations, policies and procedures of appraisal issues within mortgage insurance programs; ORProviding technical advice and policy guidance on appraisal related issues; ORConducting and preparing Multifamily appraisals or conducting and preparing Market Studies.Experience may have been gained in either the public, private sector or volunteer service. One year of experience refers to full-time work; part-time work is considered on a prorated basis. To ensure full credit for your work experience, please indicate dates of employment by month/day/year, and indicate number of hours worked per week on your resume. In addition to meeting specialized experience, applicants must have a State Certified General Real Estate Appraiser License. (You must submit a copy of your current state license and certification to be considered. Failure to submit this required documentation will result in loss of consideration for this position.)https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-3009912581138333&output=html&h=280&adk=454280460&adf=1745219964&pi=t.aa~a.2305696978~i.10~rp.1&w=713&fwrn=4&fwrnh=100&lmt=1701707727&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=9074497764&ad_type=text_image&format=713×280&url=https%3A%2F%2Ffederalgovernmentjobs.us%2Fjobs%2FAppraiser-763495100.html%3Fid%3D571d22f6-5d31-49b5-9696-e5d758db29c2%26utm_source%3Dfgj%26utm_medium%3Demail%26utm_campaign%3Dagent&ea=0&fwr=0&pra=3&rh=179&rw=713&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTAuMC4wIiwieDg2IiwiIiwiMTE5LjAuNjA0NS4xOTkiLG51bGwsMCxudWxsLCI2NCIsW1siR29vZ2xlIENocm9tZSIsIjExOS4wLjYwNDUuMTk5Il0sWyJDaHJvbWl1bSIsIjExOS4wLjYwNDUuMTk5Il0sWyJOb3Q_QV9CcmFuZCIsIjI0LjAuMC4wIl1dLDBd&dt=1701707729009&bpp=1&bdt=707&idt=-M&shv=r20231129&mjsv=m202311280101&ptt=9&saldr=aa&abxe=1&prev_fmts=0x0%2C728x280%2C728x280&nras=2&correlator=6944786187626&frm=20&pv=1&ga_vid=2036627413.1701707729&ga_sid=1701707729&ga_hid=1604042902&ga_fc=1&u_tz=-480&u_his=1&u_h=1920&u_w=1080&u_ah=1880&u_aw=1080&u_cd=24&u_sd=1&dmc=8&adx=153&ady=2312&biw=1047&bih=1794&scr_x=0&scr_y=0&eid=44759875%2C44759926%2C31079437%2C31079606%2C31079759%2C44798934%2C44809005%2C31078301%2C31079860%2C44806139%2C44807764%2C44808149%2C44808285%2C44809072%2C31078663%2C31078665%2C31078668%2C31078670&oid=2&pvsid=1816740158419175&tmod=214127658&uas=3&nvt=1&fc=1408&brdim=1085%2C2%2C1085%2C2%2C1080%2C2%2C1080%2C1920%2C1064%2C1794&vis=1&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&td=1&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=4&uci=a!4&btvi=1&fsb=1&dtd=211If you are listed on: the GSA’s Excluded Parties List system (SAM); listed on the system Award Management (LDP) list; listed on HUD’s Credit Alert Verification Reporting System (CAIVRS); you may be ineligible to perform appraisals due to sanctions.EducationThis job does not have an education qualification requirement.Additional informationOTHER INFORMATION:We may select from this announcement or any other source to fill one or more vacancies.Relocation expenses will not be paid.Relocation incentive will not be paid.A recruitment incentive may be paid to newly appointed (non-Federal) applicants. A service agreement will be required.This is a bargaining unit position.This position is Non-Exempt from the Fair Labor Standards Act (FLSA).HUD offers alternative and flexible work schedules.This announcement may be used to fill additional vacancies for similar positions across HUD. During the online application process, you will be asked to specify if you would like your application information shared with other hiring managers in the Program Office listed in this announcement or in other HUD Program Offices. Opting to share your application information will not impact your application for this announcement, nor will it guarantee further consideration for additional positions.CONDITIONS OF EMPLOYMENT (CONTINUED):HUD employees are subject to a number of government-wide and HUD specific ethics laws and regulations, including restrictions on working in a real estate related business, and having Section 8 tenants, along with other prohibited interests and activities. To review applicable ethics rules and HUD specific restrictions, please visit https://portal.hud.gov/hudportal/HUD?src=/program_offices/general_counsel/ethics.BenefitsA career with the U.S. government provides employees with a comprehensive benefits package. As a federal employee, you and your family will have access to a range of benefits that are designed to make your federal career very rewarding. Opens in a new windowLearn more about federal benefits.Review our benefitsEligibility for benefits depends on the type of position you hold and whether your position is full-time, part-time or intermittent. Contact the hiring agency for more information on the specific benefits offered.How You Will Be EvaluatedYou will be evaluated for this job based on how well you meet the qualifications above.Your application includes your resume, responses to the online questions, and required supporting documents. Please be sure that your resume includes detailed information to support your qualifications for this position; failure to provide sufficient evidence in your resume may result in a “not qualified” determination. Rating: Your application will be evaluated in the following areas: Analytical, Communication, and Technical. Category rating will be used to rank and select eligible candidates. If qualified, you will be assigned to one of three quality level categories: Best (highest quality category), Better (middle quality category), or Good (minimally qualified category) depending on your responses to the online questions, regarding your experience, education, and training related to this position. Your rating may be lowered if your responses to the online questions are not supported by the education and/or experience described in your application. Veterans’ preference is applied after applicants are assessed. Preference-eligibles will be listed at the top of their assigned category and considered before non-preference-eligibles in that category.https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-3009912581138333&output=html&h=280&adk=3555556622&adf=2882727993&pi=t.aa~a.2638703807~i.3~rp.4&w=713&fwrn=4&fwrnh=100&lmt=1701707727&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=9074497764&ad_type=text_image&format=713×280&url=https%3A%2F%2Ffederalgovernmentjobs.us%2Fjobs%2FAppraiser-763495100.html%3Fid%3D571d22f6-5d31-49b5-9696-e5d758db29c2%26utm_source%3Dfgj%26utm_medium%3Demail%26utm_campaign%3Dagent&ea=0&fwr=0&pra=3&rh=179&rw=713&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTAuMC4wIiwieDg2IiwiIiwiMTE5LjAuNjA0NS4xOTkiLG51bGwsMCxudWxsLCI2NCIsW1siR29vZ2xlIENocm9tZSIsIjExOS4wLjYwNDUuMTk5Il0sWyJDaHJvbWl1bSIsIjExOS4wLjYwNDUuMTk5Il0sWyJOb3Q_QV9CcmFuZCIsIjI0LjAuMC4wIl1dLDBd&dt=1701707729009&bpp=1&bdt=707&idt=-M&shv=r20231129&mjsv=m202311280101&ptt=9&saldr=aa&abxe=1&prev_fmts=0x0%2C728x280%2C728x280%2C713x280&nras=3&correlator=6944786187626&frm=20&pv=1&ga_vid=2036627413.1701707729&ga_sid=1701707729&ga_hid=1604042902&ga_fc=1&u_tz=-480&u_his=1&u_h=1920&u_w=1080&u_ah=1880&u_aw=1080&u_cd=24&u_sd=1&dmc=8&adx=153&ady=3586&biw=1047&bih=1794&scr_x=0&scr_y=0&eid=44759875%2C44759926%2C31079437%2C31079606%2C31079759%2C44798934%2C44809005%2C31078301%2C31079860%2C44806139%2C44807764%2C44808149%2C44808285%2C44809072%2C31078663%2C31078665%2C31078668%2C31078670&oid=2&pvsid=1816740158419175&tmod=214127658&uas=3&nvt=1&fc=1408&brdim=1085%2C2%2C1085%2C2%2C1080%2C2%2C1080%2C1920%2C1064%2C1794&vis=1&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&td=1&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=5&uci=a!5&btvi=2&fsb=1&dtd=216Qualified preference-eligibles with a compensable service-connected disability of 10% or more will be listed at the top of the highest category.Referral: If you are among the top qualified candidates, your application may be referred to a selecting official for consideration. You may be required to participate in a selection interview.If you are a displaced or surplus Federal employee (eligible for the Career Transition Assistance Plan (CTAP)/Interagency Career Transition Assistance Plan (ICTAP)) you must receive a score in the middle quality category or better to be rated as “well qualified” to receive special selection priority.Required DocumentsA complete application includes: 1. A resume: All applicants are required to submit a resume either by creating one in USAJOBS or uploading one of their own choosing. (Cover letters are optional.)To receive full credit for relevant experience, please list the month/date/year and number of hours worked for experience listed on your resume.It is suggested that you preview the online assessment questionnaire, to ensure that your resume thoroughly describes how your skills and experience align to the criteria defined in the “Qualifications” section of this announcement and support your responses to the online assessment questionnaire.For resume writing guidance, please visit USAJOBS Resources Center.2. Vacancy assessment question responses: All applicants are required to complete vacancy question responses by clicking the apply online button of this vacancy announcement.3. Submission of any required documents identified below, if applicable: Please note that if you do not provide all required information, as specified in this announcement, you may not be considered for this position (or may not receive the special consideration for which you may be eligible).VETERANS’ PREFERENCE DOCUMENTATION:If you are claiming veterans preference, please see applicant guide for required documentation In order to be considered for veterans preference, you must submit all required documentation as outlined in the applicant guide.CAREER TRANSITION ASSISTANCE PLAN (CTAP) OR INTERAGENCY CAREER TRANSITION ASSISTANCE PLAN (ICTAP) ELIGIBLE INDIVIDUALS:If you are a displaced or surplus Federal employee, in order to be eligible under one of these authorities you must submit all required documentation as outlined in this link: CTAP/ICTAPAPPRAISER DOCUMENTATION:For Multifamily Appraiser positions, you must submit a State General Real Estate Appraiser License, you must submit a copy of your current state license and certification to be considered.How to ApplyHUD has partnered with the Treasury’s Bureau of the Fiscal Service to provide certain personnel services to its organization. Fiscal Service’s responsibilities include advertising vacancies, accepting and handling applications, and extending job offers. Please review the entire announcement before applying. The following instructions outline our application process. You must complete this application process and submit any required documents by 11:59 p.m. Eastern Time (ET) on the closing date of this announcement. We are available to assist you during business hours (normally 8:00 a.m. – 5:00 p.m. ET, Monday – Friday). If applying online poses a hardship, please contact us by noon ET on the announcement’s closing date. HUD provides reasonable accommodation to applicants with disabilities on a case-by-case basis. Please contact us if you require this for any part of the application and hiring process.To begin, click Apply to access the online application. You will need to be logged into your USAJOBS account to apply. If you do not have a USAJOBS account, you will need to create one before beginning the application.Follow the prompts to select your resume and/or other supporting documents to be included with your application package. You will have the opportunity to upload additional documents to include in your application before it is submitted. Your uploaded documents may take several hours to clear the virus scan process.After acknowledging you have reviewed your application package, complete the Include Personal Information section as you deem appropriate and click to continue with the application process.You will be taken to the online application which you must complete in order to apply for the position. Complete the online application, verify the required documentation is included with your application package, and submit the application.To verify the status of your application:Log into your USAJOBS account (USAJOBS Login) A list of announcements in which you have applied will be at the Welcome screenUnder “application status,” click “Track this application” and you will be taken to the agency website where you can check your application status. For more information regarding the job and applicant status, please refer to https://www.usajobs.gov/Help/how-to/application/status/.If you wish to make changes/updates to your application and the vacancy is still open, you can click on the job announcement and “Update Application” to be taken back to your application. No updates can be made once the announcement has closed.Please notify us if your contact information changes after the closing date of the announcement. Also, note that if you provide an email address that is inaccurate or if your mailbox is full or blocked (e.g., spam-blocker), you may not receive important communication that could affect your consideration for this position.For additional information on how to apply, please visit the Partnership for Public Service’s Go Government website.To preview the assessment questionnaire: https://apply.usastaffing.gov/ViewQuestionnaire/12221526Agency contact informationApplicant Call CenterPhone304-480-7300Emailhudinquiries@fiscal.treasury.govAddressAsst Secretary for Housing-Federal Housing Commissioner Administrative Resource Center Parkersburg, WV 26101 USLearn more about this agencyNext stepsOnce the online questionnaire is received, you will receive an acknowledgement email that your submission was successful. We will review your resume and transcript(s) (if appropriate) to ensure you meet the basic qualification requirements. We will evaluate each applicant who meets the basic qualifications on the information provided and may interview the best-qualified applicants. After making a tentative job offer, we will conduct any required suitability and/or security background investigation.OverviewOpen & closing dates12/04/2023 to 12/18/2023Salary$110,798 – $149,651 per yearPay scale & gradeGS 13Locations1 vacancy in the following locations:Baltimore, MDBoston, MANew York, NYRemote jobNoTelework eligibleYes—as determined by the agency policy.Travel RequiredOccasional travel – You may be expected to travel for this position.Relocation expenses reimbursedNoAppointment typePermanent -Work scheduleFull-time -ServiceCompetitivePromotion potential13Job family (Series)1171 AppraisingSupervisory statusNoSecurity clearanceNot RequiredDrug testNoAnnouncement number24-HUD-320-PControl number763495100 How to Apply HUD has partnered with the Treasury’s Bureau of the Fiscal Service to provide certain personnel services to its organization. Fiscal Service’s responsibilities include advertising vacancies, accepting and handling applications, and extending job offers. Please review the entire announcement before applying. The following instructions outline our application process. You must complete this application process and submit any required documents by 11:59 p.m. Eastern Time (ET) on the closing date of this announcement. We are available to assist you during business hours (normally 8:00 a.m. – 5:00 p.m. ET, Monday – Friday). If applying online poses a hardship, please contact us by noon ET on the announcement’s closing date. HUD provides reasonable accommodation to applicants with disabilities on a case-by-case basis. Please contact us if you require this for any part of the application and hiring process. To begin, click Apply to access the online application. You will need to be logged into your USAJOBS account to apply. If you do not have a USAJOBS account, you will need to create one before beginning the application. Follow the prompts to select your resume and/or other supporting documents to be included with your application package. You will have the opportunity to upload additional documents to include in your application before it is submitted. Your uploaded documents may take several hours to clear the virus scan process. After acknowledging you have reviewed your application package, complete the Include Personal Information section as you deem appropriate and click to continue with the application process. You will be taken to the online application which you must complete in order to apply for the position. Complete the online application, verify the required documentation is included with your application package, and submit the application. To verify the status of your application:Log into your USAJOBS account (USAJOBS Login) A list of announcements in which you have applied will be at the Welcome screen Under “application status,” click “Track this application” and you will be taken to the agency website where you can check your application status. For more information regarding the job and applicant status, please refer to https://www.usajobs.gov/Help/how-to/application/status/. If you wish to make changes/updates to your application and the vacancy is still open, you can click on the job announcement and “Update Application” to be taken back to your application. No updates can be made once the announcement has closed. Please notify us if your contact information changes after the closing date of the announcement. Also, note that if you provide an email address that is inaccurate or if your mailbox is full or blocked (e.g., spam-blocker), you may not receive important communication that could affect your consideration for this position. For additional information on how to apply, please visit the Partnership for Public Service’s Go Government website. To preview the assessment questionnaire: https://apply.usastaffing.gov/ViewQuestionnaire/12221526 Agency contact information Applicant Call Center Phone 304-480-7300 hudinquiries@fiscal.treasury.gov Address Asst Secretary for Housing-Federal Housing Commissioner Administrative Resource Center Parkersburg, WV 26101 US Learn more about this agency Next steps Once the online questionnaire is received, you will receive an acknowledgement email that your submission was successful. We will review your resume and transcript(s) (if appropriate) to ensure you meet the basic qualification requirements. We will evaluate each applicant who meets the basic qualifications on the information provided and may interview the best-qualified applicants. After making a tentative job offer, we will conduct any required suitability and/or security background investigation. Overview Open & closing dates 12/04/2023 to 12/18/2023 Salary $110,798 – $149,651 per year Pay scale & grade GS 13 Locations 1 vacancy in the following locations: Baltimore, MD Boston, MA New York, NY Remote job No Telework eligible Yes—as determined by the agency policy. Travel Required Occasional travel – You may be expected to travel for this position. Relocation expenses reimbursed No Appointment type Permanent – Work schedule Full-time – Service Competitive Promotion potential 13 Job family (Series) 1171 Appraising Supervisory status No Security clearance Not Required Drug test No Announcement number 24-HUD-320-P Control number 763495100 |

posted in Appraiser News | Comments Off on HUD Appraiser – Job Baltimore, MD Boston, MA New York, NY

Getting more appraisal work with Yelp reviews

In today’s digital age, online reviews play a crucial role in shaping consumer decisions. Yelp, a popular online review platform, provides businesses with a unique opportunity to harness the power of customer feedback. This article explores the numerous benefits of Yelp reviews and how businesses can leverage them to achieve success.

- Increased Visibility and Trust : Yelp boasts a vast user base actively seeking recommendations for local businesses. By having a presence on Yelp and accumulating positive reviews, businesses can significantly enhance their visibility. Yelp reviews contribute to higher search engine rankings, ensuring that potential customers find your business easily. Moreover, positive reviews build trust and credibility, as consumers often rely on the experiences of others when making purchase decisions. Having a solid rating and positive testimonials on Yelp can differentiate your business from competitors and attract more customers.

- Valuable Customer Insights : Yelp reviews provide businesses with valuable insights into customer preferences, experiences, and expectations. By analyzing reviews, businesses gain a deeper understanding of what customers love about their offerings and identify areas for improvement. This feedback helps in refining products, services, and overall customer experience, ultimately leading to increased customer satisfaction and loyalty. Yelp reviews also serve as a source of feedback on specific aspects of the business, such as customer service, ambiance, or pricing, enabling businesses to make informed decisions to meet customer needs better.

- Free Marketing and Word-of-Mouth Promotion : Positive Yelp reviews act as free marketing for businesses. When customers leave glowing reviews, they essentially become brand advocates, spreading positive word-of-mouth about your business. This organic promotion can significantly expand your customer base, as potential customers trust the opinions and experiences of their peers. Additionally, positive reviews can be shared on social media platforms, further amplifying their reach and impact. By providing excellent products and services that result in positive reviews, businesses can leverage this powerful form of marketing without incurring substantial advertising costs.

- Opportunity for Reputation Management : While positive reviews are valuable, negative reviews on Yelp also provide an opportunity for businesses to showcase their commitment to customer satisfaction. Promptly responding to negative reviews and addressing concerns demonstrates transparency and a willingness to resolve issues. By engaging with dissatisfied customers in a professional and empathetic manner, businesses can turn negative experiences into positive ones and rebuild trust. A proactive approach to reputation management on Yelp showcases a business’s dedication to customer service and its commitment to continuous improvement.

Yelp reviews offer businesses a host of benefits, including increased visibility, valuable customer insights, free marketing, and an opportunity for reputation management. By actively managing their presence on Yelp, businesses can harness the power of customer feedback to enhance their brand, build customer trust, and drive business success in the digital landscape.

posted in Appraiser News | Comments Off on Getting more appraisal work with Yelp reviews

Real Estate Appraiser Jobs with the Internal Revenue Service

| Vacancy No. | 23-11757189K-LBB-1171-13 | Department | Internal Revenue Service |

| Salary | $94,373.00 to $150,703.00 | Grade | 13 to 13 |

| Perm/Temp | Permanent | FT/PT | Full-time |

| Open Date | 12/20/2022 | Close Date | 9/20/2023 |

| Job Link | Apply Online | Who may apply | Status Candidates |

WHAT IS THE LARGE BUSINESS AND INTERNATIONAL (LBI) DIVISION?

A description of the business units can be found at: https://www.jobs.irs.gov/about/who/business-divisions

Vacancies will be filled in the following specialty areas:

LB&I, Eastern Compliance Area

The following are the duties of this position at the full working level. If this vacancy includes more than one grade and you are selected at a lower grade level, you will have the opportunity to learn to perform these duties and receive training to help you grow in this position.

- Performs unique, often controversial, and precedent setting appraisals of real and personal property where the appraisal will have significant tax impact, affect large segments of taxpayers, and will involve intense public scrutiny, with potential to affect legislative change. Provides expertise to government attorneys on cases with probable litigation potential. Serves as expert witness in U.S. Tax Court or U.S. District Court.

- Personally performs appraisals and reviews appraisals prepared by recognized experts and authorities in the industry and other valuation specialists in the group. Conducts conferences with taxpayers, representatives, and experts to explain findings which are often vigorously contested. Prepares appraisal reports which represent the Service’s position and documents conclusions with accurate facts and arguments for unagreed issues.

- Examines and appraises extensive property holdings in estate portfolios of prominent, recognized business, entertainment and industry leaders often widely publicized and intensely scrutinized.

- Serves as a team member on CEP and large business examinations. Identifies and develops significant issues which may be unusual and unique, subject to interpretation and may be adopted as the Service position in all similar cases. Issues are often complicated by numerous layers of related corporations and partnerships, self serving contracts and legal agreements, creative financing and conflicting economic or business options and alternatives.

posted in Appraiser News | Comments Off on Real Estate Appraiser Jobs with the Internal Revenue Service

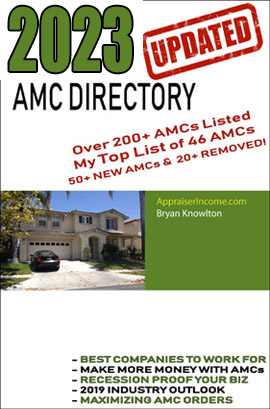

2023 Appraisal Management Company Directory NOW AVAILABLE

Do you want more appraisal orders? Are you looking to recession proof your appraisal business by getting more non-lender appraisal requests? Have you signed up to appraisal management companies and are still not getting any offers from the AMCs? Do you need a GOOD list with all the bad guys removed?

Fully updated for 2023 I have gone through the entire list, added a bunch of new companies and removed the companies that either went out of business or were acquired by larger AMCs.

If you are looking for the best list out there that is fully updated for 2023 with direct links to the AMC registration pages, look no further!

I know work has came to a screeching halt over the past few months and it is a great time to get registered with companies that are still sending out appraisal orders. Even though my offers have declined over 75% since lender rates have been increasing, I still get over 15 offers a week covering my market area.

Take the time now to get signed back up and / or verify you are signed up with the best AMCs out there.

You can get more information and place your order on this page.

posted in Appraiser News | Comments Off on 2023 Appraisal Management Company Directory NOW AVAILABLE

Review Appraiser Jobs with HUD

| Review Appraiser | SEATTLE, WA | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | PORTLAND, OR | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | LAS VEGAS, NV | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | BOISE, ID | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | HONOLULU, HI | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | SANTA ANA, CA | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | SAN FRANCISCO, CA | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | LOS ANGELES, CA | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | PHOENIX, AZ | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | ANCHORAGE, AK | Pub | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | SEATTLE, WA | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | PORTLAND, OR | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | LAS VEGAS, NV | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | BOISE, ID | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | HONOLULU, HI | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | SANTA ANA, CA | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | SAN FRANCISCO, CA | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | LOS ANGELES, CA | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | PHOENIX, AZ | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Review Appraiser | ANCHORAGE, AK | Gov | Department of Housing and Urban Development | 12/20/2022 |

| Vacancy No.23-HUD-342-PDepartmentAssistant Secretary for Housing-Federal Housing CommissionerSalary$105,581.00 to $168,926.00Grade13 to 13Perm/TempPermanentFT/PTFull-timeOpen Date12/6/2022Close Date12/20/2022Job LinkApply OnlineWho may applyPublicLocations:ANCHORAGE, AKPHOENIX, AZLOS ANGELES, CASAN FRANCISCO, CASANTA ANA, CAHONOLULU, HIBOISE, IDLAS VEGAS, NVPORTLAND, ORSEATTLE, WA |

Summary

This position is located at Department of Housing and Urban Development, Asst Secretary for Housing-Federal Housing Commissioner.

This opportunity is also open to Status eligibles under announcement 23-HUD-341. Please refer to that announcement for details on open period, eligibility, and how to apply.

posted in Appraiser News | Comments Off on Review Appraiser Jobs with HUD

Lead Appraiser Jobs with Dept of the Treasury

| Vacancy No. | 23-11686635O-LBB-1171-14 | Department | Internal Revenue Service |

| Salary | $115,974.00 to $167,134.00 | Grade | 14 to 14 |

| Perm/Temp | Permanent | FT/PT | Full-time |

| Open Date | 10/21/2022 | Close Date | 11/3/2022 |

| Job Link | Apply Online | Who may apply | Status Candidates |

| Locations: | |||

| PHOENIX, AZSACRAMENTO, CADENVER, COHOUSTON, TXSEATTLE, WA |

| Job Description (Please follow all instructions carefully) |

|---|

| Vacancies will be filled in the following specialty areas: LB&I Eastern Compliance Practice Area, Director Field Operations, Engineering, Engineer Territory 7. The following are the duties of this position at the full working level. If this vacancy includes more than one grade and you are selected at a lower grade level, you will have the opportunity to learn to perform these duties and receive training to help you grow in this position.Utilizing extensive and specialized knowledge of engineering and valuation techniques and practices, the incumbent provides leadership to a team of Appraisers. The team leader provides technical direction and support to assist team coordinators, revenue agents, other non-engineering specialists, and Appraisal team members on appraisal cases and on the largest and most complex appraisal and valuation issues. The incumbent serves as a field expert developing new theory, knowledge, and practice and is a recognized authority, both within and outside the Service, in the field of appraisal and valuation.Ensures that the organization’s strategic plan, mission, vision and, values are communicated to the team and integrated into the team’s strategies, goals, objectives, work plans, and work products and services.Articulates and communicates to the team the assignment project, problem to be solved, actionable events, milestones, and/or program issues under review, and deadlines and time frames for completion.Coaches the team in the selection and application of appropriate problem solving methods and techniques, provide advice on work methods, practices and procedures, and assist the team and/or individual members in identifying the parameters of a viable solution.Maintains program and administrative reference materials, project files, and relevant background documents. Makes available policies, procedures and written instructions from the supervisor; maintains current knowledge to answer questions from team members on procedures, policies, directives, etc.Prepares reports and maintains records of work accomplishments and personal administrative information, and coordinates the preparation, presentation, and communication of work-related information to the supervisor.Represents the team in dealings with the supervisor or manager for the purpose of obtaining resources (e.g., computer hardware and software, use of overtime or compensatory time) and securing needed information or decisions from the supervisor on major work problems and issues that arise. Ensures that the organization’s strategic plan, mission, vision and, values are communicated to the team and integrated into the team’s strategies, goals, objectives, work plans, and work products and services.Requirements Conditions of EmploymentSTANDARD POSITION DESCRIPTIONS (SPD): PD95653 Visit the IRS SPD Library to access the position descriptions.f you are in a telework eligible position, you may be directed to temporarily telework on a full-time basis due to COVID 19. Employees must be within a 200-mile radius of their official assigned post-of-duty (POD) while in a telework status. Once normal operations resume, employees may be directed back to the office to perform the duties of their position. Telework eligibility does not guarantee telework; employees must meet and sustain IRS telework eligibility requirements and supervisor’s approval to participate in the IRS Telework Program. As a reminder – If you are selected for a position, you are responsible for reporting to your designated POD (location) on the negotiated start date or as directed by management.Obtain and use a Government-issued charge card for business-related travel.QualificationsFederal experience is not required. The experience may have been gained in the public sector, private sector or Volunteer Service. One year of experience refers to full-time work; part-time work is considered on a prorated basis. To ensure full credit for your work experience, please indicate dates of employment by month/year, and indicate number of hours worked per week, on your resume. You must meet the following requirements by the closing date of this announcement: SPECIALIZED EXPERIENCE GS-14: You must have 1 year of specialized experience at a level of difficulty and responsibility equivalent to the GS-13 grade level in the Federal service. To be qualifying your experience must demonstrate mastery of appraisal principles and concepts needed to serve as a technical authority, where you will be required to analyze and evaluate newly emerging valuation theories to establish conformity with Service policies and industry standards; Comprehensive knowledge of tax laws, regulations, rulings, and court decisions and ability to interpret law and apply it to new valuation issues which are controversial and potentially precedent setting and to reach conclusions where guidelines are unclear, conflicting or often non-existent and where determinations may affect widespread segments of taxpayers, industries and communities and involve intense public and legal scrutiny; Experience providing expertise to government attorneys on cases with probable litigation potential; Experience applying extensive knowledge to an extremely broad range of properties, interests and issues of the most complex nature and unique characteristics such as; hospitals, universities, parks, racetracks, oil tank farms, as well as holdings in banking, brokerage and insurance industries, large and foreign controlled corporations, REITs (real estate investment trusts), and large multi-million dollar estate portfolios of prominent individuals; Problems often include: conflicting uses, complex legal problems, and structured agreements and financing arrangements between multiple related entities which disguise the substance of issues. At this level, you must demonstrate experience devising innovative methods and techniques for estimating the value of properties with unique and complex characteristics and resolving conflicts. AND MEET TIME IN GRADE (TIG) REQUIREMENT: For positions above the GS-05, applicants must meet applicable time-in-grade requirements to be considered eligible. One year (52 weeks) at the next lower grade level is required to meet the time-in-grade requirements for the grade you are applying for. AND TIME AFTER COMPETITIVE APPOINTMENT: By the closing date (or if this is an open continuous announcement, by the cut-off date) specified in this job announcement, current civilian employees must have completed at least 90 days of federal civilian service since their latest non-temporary appointment from a competitive referral certificate, known as time after competitive appointment. For this requirement, a competitive appointment is one where you applied to and were appointed from an announcement open to “All US Citizens”. For more information on qualifications please refer to OPM’s Qualifications Standards.EducationA copy of your transcripts or equivalent documentation is required for positions with an education requirement, or if you are qualifying based on education or a combination of education and experience. An official transcript will be required if you are selected. If the position has specific education requirements and you currently hold, or have previously held, a position in the same job series with the IRS, there is no need to submit a transcript or equivalent at this time. Applicants are encouraged, but are not required, to submit an SF-50 documenting experience in a specific series. A college or university degree generally must be from an accredited (or pre-accredited) college or university recognized by the U.S. Department of Education. For a list of schools which meet these criteria, please refer to Department of Education Accreditation page. FOREIGN EDUCATION: Education completed in foreign colleges or universities may be used to meet the requirements. You must show proof the education credentials have been deemed to be at least equivalent to that gained in conventional U.S. education program. It is your responsibility to provide such evidence when applying. Click here for Foreign Education Credentialing instructions.Additional informationWe may select from this announcement or any other source to fill one or more vacancies. Additional jobs may be filled.The salary range indicated in this announcement reflects the minimum locality pay up to maximum locality pay for all duty locations listed. The range will be adjusted for selected duty location. General Schedule locality pay tables may be found under Salaries & Wages.This is a bargaining unit position.Tour of Duty: Day ShiftAlternative work schedule, staggered work hours or telework may be available.Relocation expenses – NoPlease consider each location carefully when applying. If you are selected for a position at one of your location selections, that location will become your official post of duty.BenefitsReview our benefitsHow You Will Be EvaluatedYou will be evaluated for this job based on how well you meet the qualifications above.Your application includes your resume, responses to the online questions, and required supporting documents. Please be sure that your resume includes detailed information to support your qualifications for this position; failure to provide sufficient evidence in your resume may result in a “not qualified” determination. Rating: Your application will be evaluated on the Critical Job Elements (CJE) of the position to be filled, in accordance with Article 13 of the IRS/NTEU National Agreement. Your application will also be rated and ranked among others, based on your responses to the online questions/assessment. Your experience, education, training, prior performance, and awards, relevant to the position being filled, will be considered throughout the hiring process. IRS employees may obtain most recent awards listing at https://persinfo.web.irs.gov/.https://googleads.g.doubleclick.net/pagead/ads?client=ca-pub-3009912581138333&output=html&h=280&adk=3834716541&adf=1540382231&pi=t.aa~a.168325614~i.6~rp.1&w=713&fwrn=4&fwrnh=100&lmt=1666544909&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=9074497764&ad_type=text_image&format=713×280&url=http%3A%2F%2Ffederalgovernmentjobs.us%2Fjobs%2FLead-Appraiser-684555300.html%3Fid%3D571d22f6-5d31-49b5-9696-e5d758db29c2%26utm_source%3Dfgj%26utm_medium%3Demail%26utm_campaign%3Dagent&fwr=0&pra=3&rh=179&rw=713&rpe=1&resp_fmts=3&wgl=1&fa=27&dt=1666544915352&bpp=2&bdt=3194&idt=2&shv=r20221019&mjsv=m202210170101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D2ee2a9166d757f49-2214eeee9ad50019%3AT%3D1663597627%3ART%3D1663597627%3AS%3DALNI_MY6lFuBXsCuhbn-k7hO9NVV1A6oXg&gpic=UID%3D000008c57e1ba91a%3AT%3D1663597627%3ART%3D1666544913%3AS%3DALNI_MZNYjR4W5zyGduvl2FwBVQkl2JoTg&prev_fmts=0x0%2C728x280%2C728x280&nras=2&correlator=4051839597259&frm=20&pv=1&ga_vid=825663497.1663597628&ga_sid=1666544914&ga_hid=1167342755&ga_fc=1&u_tz=-420&u_his=1&u_h=1920&u_w=1080&u_ah=1880&u_aw=1080&u_cd=24&u_sd=1&adx=161&ady=4532&biw=1063&bih=1777&scr_x=0&scr_y=0&eid=44759875%2C44759926%2C44759842%2C44761793%2C42531705%2C31070416%2C44775016&oid=2&pvsid=1120113077119493&tmod=610265125&uas=3&nvt=1&eae=0&fc=1408&brdim=0%2C0%2C0%2C0%2C1080%2C0%2C1080%2C1880%2C1080%2C1777&vis=1&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=23&ifi=5&uci=a!5&btvi=1&fsb=1&xpc=1zG9PG3hBD&p=http%3A//federalgovernmentjobs.us&dtd=22Referral: If you are among the top qualified candidates, your application may be referred to a selecting official for consideration. You may be required to participate in a selection interview (telephonic and/or in person at the discretion of the Selecting Official in accordance with hiring polices). We will not reimburse costs related to the interview such as travel to and from the interview site.If you are a displaced or surplus Federal employee eligible for Career Transition Assistance Plan (CTAP), you must receive a score of 80 or better to be rated as well qualified to receive special selection priority.BenefitsReview our benefitsRequired DocumentsAs a new or existing federal employee, you and your family may have access to a range of benefits. Your benefits depend on the type of position you have – whether you’re a permanent, part-time, temporary or an intermittent employee. You may be eligible for the following benefits, however, check with your agency to make sure you’re eligible under their policies.The following documents are required and must be provided with your application. All application materials, including transcripts, must be in English.Resume – Your resume MUST contain dates of employment (i.e., month/year to month/year or to present). To ensure you receive full credit for relevant experience, include the hours worked per week. If including Federal service experience, provide pay plan, series and grade, i.e. GS-0301-09. Your resume must NOT include photographs, inappropriate content, or personal information such as age, gender, religion, social security number. If your resume does not contain the required information specified, or contains prohibited information as listed above, your application will be determined incomplete, and you will not receive consideration for this position. (Cover letters are optional.) Please view Resume Tips.Online Application – Questionnaire responsesEducation – See Education Section abovePerformance Appraisal/Awards – Submit a copy of your most recent completed performance appraisal. If a revalidated appraisal is used for merit promotion, the supervisor must prepare a narrative for each critical job element that does not have a narrative describing the performance in the appraisal period covered by the rating. Note: If you are a manager or management official, your most recent annual performance appraisal must be used for the overall rating identified.Registration/License (if applicable) – active, current registration/licenseIRS Reassignment Preference Program (RPP)(if applicable) – You MUST meet the requirements in your RPP notice. Submit a copy of your RPP Notice along with a copy of your most recent annual performance appraisal. Your performance appraisal must have a fully successful or higher overall rating.Career Transition Assistance Plan (CTAP)(if applicable) – You MUST submit the required documentation as outlined at: Career Transition Assistance Plan (CTAP). If you are an IRS CTAP eligible, you can apply for jobs within and outside the commuting area. If you are a Treasury CTAP eligible can apply for jobs within the commuting area.Please note that if you do not provide all required information, as specified in this announcement, your application will be determined incomplete, and you will not be considered for this position (or may not receive the special consideration for which you may be eligible).How to ApplyThe following instructions outline our application process. You must complete this application process and submit any required documents by 11:59 p.m. Eastern Time (ET) on 11/03/2022 and/or cut-off dates in this announcement. We are available to assist you during business hours (normally 8:00 a.m. – 4:00 p.m. ET, Monday – Friday). If applying online poses a hardship, please contact us by noon ET on 11/03/2022. To preview the Application Questionnaire, please click the following link: https://apply.usastaffing.gov/ViewQuestionnaire/11686635To begin the application process, click the “Apply Online” button.You will be re-directed to USASTAFFING to complete your application process; answer the online questions and submit all required documents. (To submit supporting documents, import documents from USAJOBS to the appropriate document types. If the document you need was not imported from USAJOBS, you may upload it directly into this application. To protect your privacy, we suggest you first remove your SSN).To complete, you must click the “Submit Application” button prior to 11:59 PM (ET) on 11/03/2022.To update your application, including supporting documentation, at any time during the announcement open period, return to your USAJOBS account (https://my.usajobs.gov/Account/Login). There you will find a record of your application, the application status, and an option to Update Application. This option will no longer be available once the announcement has closed.To verify the status of your application both during and after the announcement open period, log into your USAJOBS account: https://my.usajobs.gov/Account/Login . All of your applications will appear on the Welcome page. The application record in your USAJOBS account provides an Additional Application Information page that provides information regarding the documentation you submitted and any correspondence we have sent related to this application. The Application Status will appear along with the date your application was last updated. For information on what each Application Status means, visit: https://www.usajobs.gov/Help/how-to/application/status/.Agency contact information (ERC) Employee Resource CenterPhone866-743-5748EmailHCO.Ogden.Internal@irs.govWebsitehttps://irssource.web.irs.gov/Lists/General%20News/DispItemForm.aspx?ID=624AddressLarge Business and International Director Eastern Compliance 1111 Constitution Ave NW Washington, DC 20224 USLearn more about this agencyNext stepsTreasury believes in a working environment that supports inclusion; please view our reasonable accommodation policies and procedures at https://www.jobs.irs.gov/midcareer/reasonable-accommodation.html. We will provide reasonable accommodation to applicants with disabilities on a case-by-case basis; please contact us if you require this for any part of the application and hiring process. Once your application package and online questionnaire is received you will receive an acknowledgement email. You are responsible for checking status updates and notifications in USAJOBS. Hard copy notifications will not be sent to you. You may check the status of your application for this position at any time by logging onto the USAJOBS “My Account” tab and clicking on “Application Status.” For a more detailed update of your application status, you may click on “more information.” Please notify us if your contact information changes after the closing date of the announcement. If your email mailbox is full or blocked (SPAM) you may not receive important communication that could affect your consideration for this position. As a current employee, you know the great benefits we offer. Should you have any questions about benefits, please contact the Employee Resource Center (ERC) at 1-866-743-5748 option #1 for ERC.Fair and TransparentThe Federal hiring process is set up to be fair and transparent. Please read the following guidance.Equal Employment Opportunity (EEO) PolicyReasonable accommodation policyFinancial suitabilitySelective ServiceNew employee probationary periodSignature and false statementsPrivacy ActSocial security number requestRequired DocumentsThe following documents are required and must be provided with your application. All application materials, including transcripts, must be in English.Resume – Your resume MUST contain dates of employment (i.e., month/year to month/year or to present). To ensure you receive full credit for relevant experience, include the hours worked per week. If including Federal service experience, provide pay plan, series and grade, i.e. GS-0301-09. Your resume must NOT include photographs, inappropriate content, or personal information such as age, gender, religion, social security number. If your resume does not contain the required information specified, or contains prohibited information as listed above, your application will be determined incomplete, and you will not receive consideration for this position. (Cover letters are optional.) Please view Resume Tips.Online Application – Questionnaire responsesEducation – See Education Section abovePerformance Appraisal/Awards – Submit a copy of your most recent completed performance appraisal. If a revalidated appraisal is used for merit promotion, the supervisor must prepare a narrative for each critical job element that does not have a narrative describing the performance in the appraisal period covered by the rating. Note: If you are a manager or management official, your most recent annual performance appraisal must be used for the overall rating identified.Registration/License (if applicable) – active, current registration/licenseIRS Reassignment Preference Program (RPP)(if applicable) – You MUST meet the requirements in your RPP notice. Submit a copy of your RPP Notice along with a copy of your most recent annual performance appraisal. Your performance appraisal must have a fully successful or higher overall rating.Career Transition Assistance Plan (CTAP)(if applicable) – You MUST submit the required documentation as outlined at: Career Transition Assistance Plan (CTAP). If you are an IRS CTAP eligible, you can apply for jobs within and outside the commuting area. If you are a Treasury CTAP eligible can apply for jobs within the commuting area.Please note that if you do not provide all required information, as specified in this announcement, your application will be determined incomplete, and you will not be considered for this position (or may not receive the special consideration for which you may be eligible).How to ApplyThe following instructions outline our application process. You must complete this application process and submit any required documents by 11:59 p.m. Eastern Time (ET) on 11/03/2022 and/or cut-off dates in this announcement. We are available to assist you during business hours (normally 8:00 a.m. – 4:00 p.m. ET, Monday – Friday). If applying online poses a hardship, please contact us by noon ET on 11/03/2022. To preview the Application Questionnaire, please click the following link: https://apply.usastaffing.gov/ViewQuestionnaire/11686635To begin the application process, click the “Apply Online” button.You will be re-directed to USASTAFFING to complete your application process; answer the online questions and submit all required documents. (To submit supporting documents, import documents from USAJOBS to the appropriate document types. If the document you need was not imported from USAJOBS, you may upload it directly into this application. To protect your privacy, we suggest you first remove your SSN).To complete, you must click the “Submit Application” button prior to 11:59 PM (ET) on 11/03/2022.To update your application, including supporting documentation, at any time during the announcement open period, return to your USAJOBS account (https://my.usajobs.gov/Account/Login). There you will find a record of your application, the application status, and an option to Update Application. This option will no longer be available once the announcement has closed.To verify the status of your application both during and after the announcement open period, log into your USAJOBS account: https://my.usajobs.gov/Account/Login . All of your applications will appear on the Welcome page. The application record in your USAJOBS account provides an Additional Application Information page that provides information regarding the documentation you submitted and any correspondence we have sent related to this application. The Application Status will appear along with the date your application was last updated. For information on what each Application Status means, visit: https://www.usajobs.gov/Help/how-to/application/status/.Agency contact information (ERC) Employee Resource CenterPhone866-743-5748EmailHCO.Ogden.Internal@irs.govWebsitehttps://irssource.web.irs.gov/Lists/General%20News/DispItemForm.aspx?ID=624AddressLarge Business and International Director Eastern Compliance 1111 Constitution Ave NW Washington, DC 20224 USLearn more about this agencyNext stepsTreasury believes in a working environment that supports inclusion; please view our reasonable accommodation policies and procedures at https://www.jobs.irs.gov/midcareer/reasonable-accommodation.html. We will provide reasonable accommodation to applicants with disabilities on a case-by-case basis; please contact us if you require this for any part of the application and hiring process. Once your application package and online questionnaire is received you will receive an acknowledgement email. You are responsible for checking status updates and notifications in USAJOBS. Hard copy notifications will not be sent to you. You may check the status of your application for this position at any time by logging onto the USAJOBS “My Account” tab and clicking on “Application Status.” For a more detailed update of your application status, you may click on “more information.” Please notify us if your contact information changes after the closing date of the announcement. If your email mailbox is full or blocked (SPAM) you may not receive important communication that could affect your consideration for this position. As a current employee, you know the great benefits we offer. Should you have any questions about benefits, please contact the Employee Resource Center (ERC) at 1-866-743-5748 option #1 for ERC.Fair & TransparentThe Federal hiring process is set up to be fair and transparent. Please read the following guidance.Equal Employment Opportunity (EEO) PolicyReasonable accommodation policyFinancial suitabilitySelective ServiceNew employee probationary periodSignature and false statementsPrivacy ActSocial security number requestOverviewOpen & closing dates10/21/2022 to 11/03/2022Salary$115,974 – $167,134 per yearPay scale & gradeGS 14Locations1 vacancy in the following locations:Phoenix, AZSacramento, CADenver, COHouston, TXSeattle, WARemote jobNoTelework eligibleYes—as determined by the agency policy.Travel Required25% or less – You may be expected to travel for this position.Relocation expenses reimbursedNoAppointment typePermanent -Work scheduleFull-time -ServiceCompetitivePromotion potential14Job family (Series)1171 AppraisingSupervisory statusNoSecurity clearanceNot RequiredDrug testNoPosition sensitivity and riskModerate Risk (MR)Trust determination processSuitability/FitnessAnnouncement number23-11686635O-LBB-1171-14Control number684555300 |

posted in Appraiser News | Comments Off on Lead Appraiser Jobs with Dept of the Treasury

IRS Appraiser Jobs for Qualified Appraisers

| Vacancy No. | 23-11686117P-LBX-1171-13 | Department | Internal Revenue Service |

| Salary | $94,373.00 to $142,595.00 | Grade | 13 to 13 |

| Perm/Temp | Permanent | FT/PT | Full-time |

| Open Date | 10/13/2022 | Close Date | 10/12/2023 |

| Job Link | Apply Online | Who may apply | Status Candidates |

| Locations: | |||

| CENTRAL, AZPHOENIX, AZLOS ANGELES, CASACRAMENTO, CASAN DIEGO, CADENVER, CONEW HAVEN, CTFORT LAUDERDALE, FLTAMPA, FLWEST PALM BEACH, FLATLANTA, GACHICAGO, ILBALTIMORE, MDLOWELL, MASUDBURY, MAMINNEAPOLIS, MNBALLWIN, MONEW YORK, NYPORTLAND, ORAUSTIN, TXHOUSTON, TXPOINT, TXSAN ANTONIO, TXSEATTLE, WA |

| Job Description (Please follow all instructions carefully) |

|---|