|

UPDATED: JANUARY 01, 2020 |

|

…continue reading the rest of this post: 2020 Appraisal Management Company Directory

|

UPDATED: JANUARY 01, 2020 |

|

…continue reading the rest of this post: 2020 Appraisal Management Company Directory

posted in Appraiser News | Comments Off on 2020 Appraisal Management Company Directory

The U.S. Census Bureau’s Survey of Construction’s (SOC) estimate of the number of bedrooms in new single-family homes has shown a declining trend for homes with 4 bedrooms or more since 2015. The most recent SOC data show the number of bedrooms of new homes whose construction began in 2018 (new homes started).

Nationally, the number of single-family homes started with 4 bedrooms or more declined from 44.8% in 2017 to 43.5% in 2018. These developments are linked to changes in preferences among home buyers. With more Millennials becoming prepared to buy their first home, the starter home share will rise, which means smaller homes and slightly fewer bedrooms.

Historically, new homes started with 3 or 4 bedrooms have held the highest shares and new homes started with 2 bedrooms or less or 5 bedrooms or more have held the lowest shares. The declining trend mirrors the downward trend of new single-family home size.

As of 2018, the share of new single-family homes started with 3 bedrooms was the highest of all categories, at 45%, with those with 4 bedrooms trailing at 34%. The lowest two categories were new homes started with 2 bedrooms or less and 5 bedrooms or more, with shares of only 11% and 9%, respectively.

Regionally, most Census divisions show declines for the typical number of bedrooms in single-family homes. An exception is the West North Central region, which experienced a slight rising trend.

posted in Appraiser News | Comments Off on New Homes Started With 4 or More Bedrooms Trends Lower

Conventional wisdom says the Federal Reserve won’t cut rates during an election year, to avoid looking like it’s favoring one candidate over another – unless there’s an economic shock so severe, it’s forced to act.

However, we don’t live in conventional times.

UBS, one of the world’s biggest investment banks, is predicting the Fed could lower interest rates three times in 2020, an outlook at variance with other forecasters that are calling for no change or just one rate cut this year. If it’s correct, it would put downward pressure on mortgage rates.

Damage from tariffs not covered under the Phase One trade deal signed by President Donald Trump on Wednesday will force the Fed to ease monetary policy, Arend Kapteyn, global head of economic research at UBS, said at the UBS Greater China Conference in Shanghai, China, on Tuesday.

Kapteyn is not saying there will be a financial shock to the system. Rather, Kapteyn is saying the slowdown already predicted by the Fed will be worse than expected. The central bank forecast at its December meeting that GDP growth will drop to 2% in 2020 from 2.2% in 2019.

Kapteyn said the first of the three Fed rate cut could come in March.

“We think this tariff damage is going to push U.S. growth down,” Kapteyn said in an interview with CNBC. “That’s actually going to trigger three Fed cuts, which is way off consensus, right? No one believes that. And of course when the Fed starts cutting, everyone else starts cutting.”

While the Fed doesn’t directly control mortgage rates, its decisions and forecasts influence the bond investors who do. If investors are willing to accept lower yields, that translates into lower mortgage rates.

The Phase One trade deal with China gives partial relief for about a third of existing tariffs and didn’t touch the most punishing ones.

It rolled back tariffs on about $120 billion of goods, mainly consumer items and agricultural products, to 7.5% from 15% enacted in September and it canceled additional tariffs threatened by Trump. However, the 25% tariffs on $250 billion of goods that were put in place in the first 18 months of the trade war remain in place.

Those are the ones that are costing the average U.S. household $831 a year as companies pass on the added costs to consumers, according to a Federal Reserve Bank of New York report. None of the tariffs included in that study were touched in the Phase One trade agreement.

Tariffs have already pushed the U.S. manufacturing sector into recession, Kapteyn said. The question is, what comes next for retail and for the consumer spending that accounts for about 70% of the U.S. economy.

“The issue is what happens with the retail sector, which is where the September tariffs – you’re going to get some relief from those, but those are still feeding their way into the data, and so we think you’re going to see accelerated store closures.”

posted in Appraiser News | Comments Off on UBS: Fed may cut rate three times in 2020

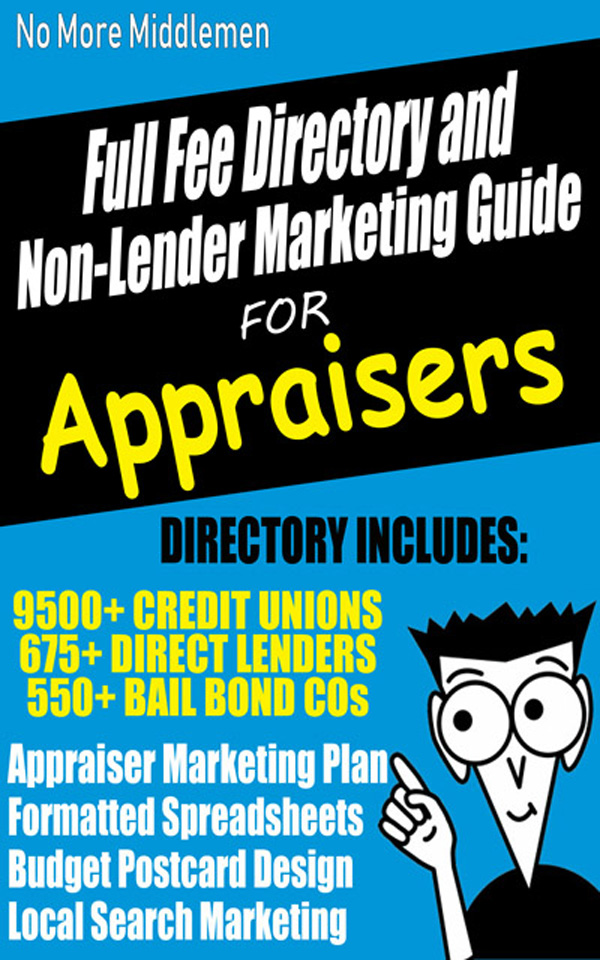

Have you noticed a significant decline of lender work over the past few months? Do you want to learn how to get more appraisal orders and finally get off the Appraisal Management Company roller coaster ride for good?

Like many appraisers I have seen a very significant decline in AMC orders over the past few months. I have been kicking myself in the butt for not getting started on my marketing to Attorneys, bail bond companies and credit unions prior to the interest rates going up.

Luckily I have a steady stream of attorney work that keeps me busy due to having a good contact management system in place and a steady client base of bail bond companies that refer their customers to me.

In this book I have detailed the steps that I take to create an inexpensive mailer to get more work from credit unions, attorneys and bail bond companies as well as the systems I use to continually get more referral work from all my past clients.

This is an incredible resource to those appraisers that are really looking to learn how do market your appraisal company and build up your client base so you don’t have to deal with seasonal and economic slow downs. This kind of work never goes away!

Possibly one of the most valuable aspects of this book is the spreadsheets that include:

2500+ Credit Unions

550+ Bail Bond Companies

300+ Direct Lenders

Chapters Include:

You are going to especially love the Bail Bond marketing information. These orders are amazing and I have been focusing a lot of my efforts to getting more of their referrals. Why?

When I am referred a customer, I quote 3 fees. I base my first fee off of complexity of the appraisal. Lets say it is a standard tract home in San Diego. I quote them $400 and will inspect within 2 working days and have the appraisal report back to them within 2 days. The second fee is to inspect within 24 hours and have back within 24 hours for $800, and finally a same day inspection and deliver of the appraisal is $1200.

Which one do you think the client wants when they are trying to get a loved one out of jail? 75% of the time it is the $1200 fee for a simple tract home appraisal.

But you do have to follow up to keep these clients, and I have listed all the techniques I use to stay in contact with these clients so the work doesn’t go away.

This resource is jammed packed with information and the spreadsheets are 100% sortable by state to make it easy to create your postcard and do your mailing as noted in Chapter 5: Step-by-Step Instructions to Make a Postcard Mailer From Card Design to Mailing

The next chapter lays out the steps I use to get a massive list of Attorneys in my market area by an inexpensive virtual assistant.

Take the time today to order my New Book & Directory – No More Middlemen – Full Fee & Appraisal Managment Free : 2014 Appraiser Marketing Guide and List of 3400+ Direct Lenders, Credit Unions and Bail Bond Companies and finally get off the crappy appraisal management company roller coaster ride for good!

Bryan Knowlton

Appraiser Income

http://www.appraiserincome.com

posted in Appraiser Marketing | Comments Off on Non-Lender Marketing Guide Available

Conforming loan limit has now increased by nearly $100,000 since 2016

The Federal Housing Finance Agency announced Tuesday that it is raising the conforming loan limits for Fannie Mae and Freddie Mac to more than $510,000.

In most of the U.S., the 2020 maximum conforming loan limit will be raised to $510,400, up from 2019’s level to $484,350.

This marks the fourth straight year that the FHFA has increased the conforming loan limits after not increasing them for an entire decade from 2006 to 2016.

In 2016, the FHFA increased the Fannie and Freddie conforming loan limit for the first time in 10 years, and since then, the loan limit has gone up by $93,400.

Back in 2016, the FHFA increased the conforming loan limits from $417,000 to $424,100. Then, the next year, the FHFA raised the loan limits from $424,100 to $453,100 for 2018. And in 2018, the FHFA increased the loan limit from $453,100 to $484,350 for 2019.

And now, loan limits will top $510,000.

…continue reading the rest of this post: Fannie Mae, Freddie Mac loan limit increases to more than $510,000posted in Appraiser News | Comments Off on Fannie Mae, Freddie Mac loan limit increases to more than $510,000

| https://www.housingwire.com/articles/fha-loan-limits-increasing-for-almost-all-of-us-in-2020/ Thanks to increases in home prices in 2019, the Federal Housing Administration loan limit will increase for nearly all of the country in 2020. 11 counties will actually see loan limits decrease According to an announcement from the FHA, the 2020 FHA loan limit for most of the country will be $331,760, an increase of nearly $17,000 over 2019’s loan limit of $314,827. That loan limit applies to much of the country, with the figure determined as a percentage of the national conforming loan limit for Fannie Mae and Freddie Mac, which is increasing in 2020 to $510,400. FHA is required by the National Housing Act, as amended by the Housing and Economic Recovery Act of 2008, to set single-family forward loan limits at 115% of median house prices, subject to a floor and a ceiling on the limits. FHA calculates forward mortgage limits by Metropolitan Statistical Area and county. FHA’s 2020 minimum national loan limit, or “floor,” of $331,760 is 65% of the national conforming loan limit of $510,400. This floor applies to “low-cost areas,” which are counties where 115% of the median home price is less than the floor limit. Meanwhile, there are a number of counties (approximately 70) where the median home price far exceeds the FHA loan limit floor. Those areas where the loan limit exceeds this floor are considered “high-cost areas”, and HERA requires the FHA to set its maximum loan limit “ceiling” for those high-cost areas at 150% of the national conforming limit. Therefore, for those approximately 70 “high-cost” counties, the FHA’s 2020 loan limit will be $765,600, an increase of nearly $40,000 over 2019’s total of $726,525. |

posted in Appraiser News | Comments Off on FHA loan limits increasing for almost all of U.S. in 2020

Mon, Mar 2, 2020, 9:00 AM –

Wed, Mar 4, 2020, 5:00 PM PST

San Diego Gas & Electric Energy® Innovation Center

4760 Clairemont Mesa Blvd

San Diego, CA 92117

Earth Advantage describes that the purpose of this training is to “educate appraisers about sustainable building practices and appraisal strategies for valuing the energy efficient and green features of a home.”

…continue reading the rest of this post: FREE Green Appraiser Certification in San Diegoposted in Appraiser News | Comments Off on FREE Green Appraiser Certification in San Diego

The new strategic plan has been posted, you can find the whole plan here: http://www.brea.ca.gov/pdf/19-352_BREA_Strategic_Plan_2020-25_ForWeb.pdf

Message from the Bureau Chief

The Bureau of Real Estate Appraisers 2020-2025 Strategic Plan is the result of participation by a broad range of stakeholders including consumers, licensees, registrants, and education providers. Survey results were insightful on both the current position of the Bureau and the state of the environment in which we operate.

The Bureau’s staff contributions were instrumental in identifying opportunities relating to dayto-day operations and mission-critical objectives.

With this input, and guidance from the Department of Consumer Affairs’ SOLID staff, the Bureau executive team developed a strategic plan that is both responsive and actionable. The plan will allow the organization to respond to change while remaining faithful to our mission.

Services provided by the appraisal profession are integral in business and the everyday life of consumers. California, with the largest number of licensees in the nation, plays a critical role in partnering with the federal government to implement requirements supporting a high level of public trust in the appraisal industry.

The Bureau must respond not only to a changing regulatory climate but also to real estate market conditions and trends which impact program processes and workload. This plan positions the Bureau to be flexible and excel in a leadership role protecting the public and consumers of appraisal services in California and nationwide.

I am proud of the work and contributions of my executive team and staff, and grateful to the survey participants for their vital input. With that I offer this road map to guide our vision of real estate appraisal excellence in California.

Sincerely,

James S. Martin, Bureau Chief

Read the entire plan here: http://www.brea.ca.gov/pdf/19-352_BREA_Strategic_Plan_2020-25_ForWeb.pdf

posted in Appraiser News | Comments Off on Bureau of Real Estate Appraisers 2020 – 2025 for CA Appraisers

You can find the whole newsletter here: https://www.fanniemae.com/content/news/current-appraiser-newsletter.pdf

This year has been a busy one. In addition to our policy work and appraisal modernization testing highlighted in earlier editions of this newsletter, we’ve been building stronger relationships with you. We’ve had thousands of conversations, answered hundreds of questions through our mailbox, listened to feedback — positive and negative — at the 25+ industry events we’ve attended, and even launched a new continuing education class through our partnership with The Columbia Institute. We’re also especially proud of our collaboration with the National Urban League to promote appraisal careers, and we’re thrilled that the Appraisal Institute has recently signed on as well. So, we want to celebrate the season by dedicating this newsletter to our partnership with you. This edition includes an overview of our mission, appraisal tool tips, a summary of the most frequent appraisal defects, and responses to common questions, including multiple parcel properties and appraisal waivers.

We hope you and your loved ones have a wonderful holiday season!

Collateral Policy Team Fannie Mae

You can find the whole newsletter here: https://www.fanniemae.com/content/news/current-appraiser-newsletter.pdf

posted in Appraiser News | Comments Off on Fannie Mae Appraiser Update

I received an email from Spot Value regarding the need for appraisers to join their panel by “invitation only” last month. Since I sign up to all the AMCs out there to test them and see if they are a good fit for the Appraisal Management Company Directory that I publish annually, I started the process and stopped immediately when they asked for payment.

ANY COMPANY THAT ASKS FOR $ TO JOIN THEIR PANEL IS A SCAM!!!!

After further research, I came across an excellent post I found over at AppraiserBlogs. Beware of Spot Value Solicitations was republished with permission from AppraisersBlogs below.

Many appraisers have gotten invitation letters in the mail from Spot Value to join their panel. The letter states that the appraiser was recommended by one of their clients and that their panel is by invitation only!

They have a website which makes them look legit. Their address at 2601 Main St, Irvine, CA 92614 is to Century Centre building but they do not provide a suite number. The domain is registered to a Michael Miller who is also the CEO and sender of the invitation letters. We were unable to reach Michael Miller at 919-404-4889. Their greeting message is computer generated and there is no voicemail setup to leave a message.

We researched the name Michael Miller and found the following:

“Mehdi Moarefian, also known as “Michael Miller,” 37, Irvine, California, was sentenced by U.S. District Judge Stefan R. Underhill in Bridgeport, Connecticut, to 52 months of imprisonment, followed by three years of supervised release, for participating in an extensive mortgage loan modification scheme. Moarefian also was ordered to pay restitution in the amount of $2,390,496.59.”

Per HousingWire, he was the ringleader of a massive mortgage modification fraud scheme.

..falsely purported to provide home mortgage loan modifications and other consumer debt relief services to numerous homeowners in Connecticut and across the United States in exchange for upfront fees…Homeowners were charged fees that typically ranged from approximately $2,500 to $4,300 for their services.

In order to induce homeowners to pay these fees, the group made a series of false representations, including: stating that the homeowners already had been approved for mortgage loan modifications on “extremely favorable” terms;

If this is the same person as the CEO of Spot Value, then it is clear that he is using the same type of tactics to scheme appraisers.

Spot Value appears to be operating as a portal, meaning they just provide a central repository of appraisers the lenders can access.

Per Spot Value website:

Spot Value makes the appraisal process quick and efficient. Appraisal orders will be assigned via email and text message and based on your member profile coverage areas and good standing within our performance rating system. You may accept or decline appraisal orders as your schedule allows, but we will continually expect a high standard of quality and timely work.

Appraiser fees: Spot Value operates with full transparency and with an ethical business model: Cost Plus. 100% of the appraisal fee goes to the appraiser, who completes the assignment. Spot Value charges a separate fee to the client for using our uniquely developed SaaS (Software as a Service) platform . Each appraiser is required to enter the fees for areas and products and are paid that amount for each order completed.

Application Fee: The application processing fee is $39.00. Application processing fee is a one-time fee for processing your application and checking against our customers blacklist. Please note that we will not review your application until your application processing fee is received.

Not an AMC: platform as a non-biased means to introduce appraisers to lenders and facilitate the flow of information and files between them.

Sounds like another pay to pay scam. Beware!

posted in Appraiser News | Comments Off on Avoid Spot Value Solicitations

|

|

|

|