| New: Collateral Underwriter Blog: Find answers, offer solutions.

Editor’s Note: The new print edition of Working RE just hit! Did you get yours? Life After the New CU System by Isaac Peck, Associate Editor – WorkingRE.com |

|

| On January 26, 2015, Fannie Mae’s new Collateral Underwriter (CU) tool was made available to lenders, an event that was highly anticipated by the appraiser community.

While Fannie Mae has been using CU to analyze appraisals since 2013, this latest move grants lenders doing business with Fannie Mae the ability to use the tool. This essentially gives lenders access to the same appraisal analytics currently being used in Fannie Mae’s quality control process and Appraiser Quality Monitoring (AQM). With lenders now having such a powerful analytical tool directly at their disposal, the big questions for appraisers are how this is going to change the appraisal process, what kind of additional work will be required, and ultimately, how this is going to change the appraisal profession going forward. How CU Works Early feedback from appraisers indicates that the CU report generates 20 “comparable” sales and ranks the appraiser’s comps within the list. Some argue that if appraisers have done their due diligence and explained their analysis, they should not worry about CU’s additional sales data. On the other hand, some appraisers feel that CU is an incredible overreach that puts pressure on the appraiser and prevents them from doing their work independently. (See Collateral Underwriter: First Feedback for more.) Just like other automated valuation models, CU analyzes comparables by looking at the proximity to the subject property, physical similarities, date of sale, and a number of other factors in determining which comparables the model prioritizes. CU also thoroughly analyzes an appraiser’s adjustments, using regression analysis and analytical models, as well as comparing the appraiser’s adjustments with adjustments reported by other local appraisers. Fannie Mae’s Director of Property Valuation and Eligibility, Robert Murphy, has said that in many cases there is no statistical significance to appraisers’ square footage adjustments, with many using generic rules-of-thumb, such as $40 a square foot, and that CU is clearly intended to address this issue. |

|

| CU also looks at Quality and Condition (Q&C) ratings, and will flag an appraiser’s rating if it differs from the prescribed definitions supplied by Fannie Mae and/or those of their peers.

What’s Changed? Additionally, according to a report issued by Mercury Network, of the 95 CU messages that affect appraisers, more than half address very simple issues that appraisers are already accustomed to dealing with regularly. However, many appraisers believe that CU will increase the number of inquiries and comp reconsiderations that appraisers field from AMCs and lenders- with the added time per report putting more pressure on the already shrinking bottom lines of many. Please Explain • The GLA adjustment for comparable #2 is smaller than peer and model adjustments. • The GLA adjustment for comparable #3 is smaller than peer and model adjustments. • The reported total below-grade area for comparable #4 is materially different than what has been reported by other appraisers. • The view adjustment for comparable #4 is materially different from peer and model adjustments. • The appraiser’s net adjustments for the comparable sales are materially different from the model net adjustment. • The quality rating for comparable #2 is materially different than what has been reported by other appraisers. Please provide supporting commentary for your data on this condition. |

|

| Richard Hagar, SRA and nationally recognized educator, says that many of the requests that he and his staff have fielded so far are questions that are already addressed in the report. “Our responses so far have been, ‘That is explained on page three.’ However, we’ve had a few instances where we needed to go back and address something that CU flagged, or ‘curing a deficiency’ in appraisal terms. So there is value in this system,” says Hagar. As the lender and AMC processes improve, appraisers may find that the number of inquiries and call backs decrease. “Good lenders and AMCs should be stopping and reading the appraisal report before contacting the appraiser regarding a CU warning message, because if the appraiser is doing his or her job correctly, an explanation supporting that should usually be in the report,” says Hagar.

However, CU will still result in more work for appraisers, according to Hagar. But the bright side may be that sloppy appraisers will be weeded out (or forced to improve) and good appraisers can raise their rates. “A lot of the good banks and AMCs recognize what’s going on and they expect appraisers to raise their rates. Some might look at this as requiring additional work but the requirement for better work, analysis, accuracy, and explanations was always there,” said Hagar. “The CU is checking to see if it REALLY is in the appraisal or is someone trying to slip an appraisal through the system without doing their job right. CU does add another level of work and an extra amount of detail. As a busy appraiser myself, I expect many appraisers to increase their fees, especially those who currently are accepting low fees and are not including the correct analysis to begin with. It’s going to be a lot harder for appraisers to slap together a report and move on.” “I’ve received two phone calls from appraisers since CU came out who are raising their rates by $100. One is overwhelmed with business because he does good work and the other is raising his rates because he’s been cutting corners and recently has been caught by the CU system- he needs more time to do proper reports. Fannie Mae has started asking him for proof of all of his adjustments, so he’s recognizing that he has to do more work to fill out the form,” says Hagar. The bottom line, according to Hagar, is that CU will enforce the requirement that proper support and explanation be in an appraisal. “Appraisers will need to explain and defend everything they’ve done in the appraisal. It could have been a Q&C rating, an adjustment, why your upstairs square footage is materially different from your peers, and much more,” Hagar says. Appraiser Access to CU Data However, some appraisers, while agreeing with the potential concerns regarding CU, take a contrarian approach with regards to giving individual appraisers access to the CU data. (Click Here to sign the petition to allow appraisers access to the UAD data.) Mike Foil, an appraiser from Arizona, writes in an online forum that while he agrees with the concerns of the Network, he does not support their solution. “We are independent appraisers who are paid to render our expert opinion about the subject property and a value for the same. If I use a comparable that, based on observation and research, believe to be a ‘C4’ for UAD purposes, but then find out from running CU ahead of submission, that other appraisers used a ‘C3’ for the same property; should I then use what other, unknown appraisers have used just so my report has one less flag? My answer is no! I am not being paid to submit a report based on what other people think, I am being paid for my professional opinion,” argues Foil. Foil says he absolutely does not want CU data when he performs his appraisals. “I want to do my job, to the best of my ability and then stand on that. Giving CU data to the appraiser is one more step toward taking the profession in the direction of becoming an automated, mechanical function of the loan process. If you are insecure and need CU to tell you how to do your job, then I believe you are part of the problem,” says Foil. This again speaks to the issue of whether appraisers should go along with what other appraisers are reporting as Q&C ratings, adjustments, or GLA in order to stay under the radar, or if the appraiser should do their own independent research and analysis, and stand by their opinions. Either way, appraisers should be prepared to support and defend their methodology and conclusions. |

Life After the New CU System

posted in Appraiser News | 0 Comments

Thinking about making the switch?

If you’d like to be more efficient but don’t know how to get there, or if you’re not completely happy with your appraisal software, I’d love to help you.

Next Friday, I’m hosting two free “Switching” webinars that cover the highlights of TOTAL as well as converting your files and databases to make the transition smooth. I’d love for you to join me:

- Switching from ClickFORMS to TOTAL: 11AM Central, April 3rd— RSVP here

- Switching from ACI to TOTAL: 1PM Central, April 3rd — RSVP here

I hope to see you in my class! If you have any questions ahead of time, even if you can’t make it, please hit reply or give me a call.

Have a wonderful weekend,

|

|

PS: To learn more about TOTAL and all of our solutions for appraisers, check out our latest catalog here.

posted in Appraiser News | 0 Comments

Mitchell Maxwell & Jackson sues state $10 Million for allegedly destroying reputation

From left: MMJ founders Jeffrey Jackson and Steven Knobel

– See more at: http://therealdeal.com/blog/2015/03/09/mitchell-maxwell-jackson-sues-state-for-destroying-reputation/#sthash.RFS7dhwv.dpuf UPDATED, 9:49 p.m., March 9: Mitchell Maxwell & Jackson, the real estate appraisal firm that was dragged through protracted litigation for allegedly affixing false signatures to appraisal documents before being vindicated last year, is now saying the state owes them $10 million as compensation for the ordeal and the havoc it caused.

Co-founder Steven Knobel claims that the state’s case ravaged his company’s reputation and was responsible for driving away most of its clients, including its biggest, Citibank. While the firm was once worth $9 million and had 30 employees, the complaint states, it has now lost the majority of its business and is down to a single employee.

An investigation was opened into Knobel and MMJ co-founder Jeffrey Jackson in 2010 when Marianne Mueller, a former star employee who was later terminated, complained to the New York Department of State that her signature had been placed on appraisals that she had not reviewed, under the direction of Knobel.

At the end of 2012, an administrative judge for the New York State Department of State decided to revoke appraisal licenses, despite what the firm calls a dearth of evidence and a disproportionate reliance on the testimony of a “disgruntled former employee” who stood to benefit from discrediting the firm because she was seeking to get out of a noncompete agreement.

According to the complaint, filed Jan. 29 in the New York Court of Claims, Mueller’s testimony was changeable and unreliable. “The state ignored this inconsistency and knowingly relied on incredible, if not perjured, testimony,” the complaint states. Additionally, Knobel claims that the state ignored a parade of appraiser witnesses who refuted Mueller’s claims and even failed to grant MMJ due process, as the complaint they were presented with was inscrutable.

This argument ultimately prevailed last year when a State Supreme Court Justice found that due process was indeed violated and that the licenses should not have been revoked. The court stated, “There was a complete paucity of proof here that Knobel and Jackson individually or jointly were behind this so-called nefarious scheme.”

Though Knobel and Jackson were able to delay the revocation of their licenses pending their appeal of the decision the damage to the company’s name was irreversible, they claim.

In a phone interview with The Real Deal Monday evening, Knobel said there was a need for an ombudsman who could step in if the state failed to do its duty and carry out a fair investigation.

“If I wasn’t a very successful appraiser who had the resources to fight this, I would have given up on Day One,” he said.

At the market’s peak, MMJ was one of New York City’s most-dominant appraisal firms, with about 3,000 clients. Now, Knobel wants retribution for the disproved accusation that unraveled a business he has run since 1991.

“Knobel lost his salary, appraisal commissions, the value of his interest in MMJ and related entities, and his very livelihood,” according to the complaint. A New York State representative declined to comment.

Hiten Samtani contributed reporting.

posted in Appraiser News | 0 Comments

Collateral Underwriter and Fannie Mae Appraisal Guideline Changes Webinar

What is Fannie Mae’s Collateral Underwriter saying about your appraisal reports? What are your clients taking away from your appraisal reports based on Collateral Underwriter?

Thanks to the expertise and hard work of appraisers throughout the country, Collateral Underwriter is the most robust and data rich appraisal review tool ever produced. This 1 hour webinar presented by AnnieMac Home Mortgage will provide the behind the scenes look at Collateral Underwriter that you need in order to keep abreast of the changes brought from this automated appraisal review tool. The webinar will also highlight some changes to appraisal guidelines from Fannie Mae over the past year.

The webinar will be presented by Wes Costello, the Collateral Valuation Director of AnnieMac Home Mortgage. The live webinar will be presented twice and will repeat the same information. First on Monday, March 30th at 5:30pm EST and then Tuesday, March 31st at 11:00am EST.

After registering, you will receive a confirmation email containing information about joining the webinar.

To register for Collateral Underwriter and Fannie Mae Appraisal Guideline Changes on Mar 30, 2015 5:30 PM EDT at:

https://attendee.gotowebinar.

Or

To register for Collateral Underwriter and Fannie Mae Appraisal Guideline Changes on Mar 31, 2015 11:00 AM EDT at:

https://attendee.gotowebinar.

presented by:

Wes Costello, the Collateral Valuation Director of AnnieMac Home Mortgage

posted in Appraiser News | 0 Comments

City’s appraisers don’t need to look inside houses, appellate court says

Ross Runfola doesn’t want an appraiser from the city coming into his home on Cleveland Avenue.

Certified appraiser John Zukowski, vice president of Emminger Newton Pigeon Magyar, Inc., collects information while looking at a property on Lancaster Avenue in Buffalo on Monday. Derek Gee/Buffalo News

Robert Freedman feels the same way about an appraiser in his home on Chatham Avenue.

They are among some 80 Buffalo homeowners who contend the city does not have the right to send an appraiser into their homes to assess values without their permission.

Earlier this month – after six years of litigation – an appeals court agreed.

The ruling from the state Appellate Division in Rochester says a homeowner can refuse entry to an appraiser without being penalized. And the decision has implications for appraisal challenges in suburban municipalities from Hamburg to Lockport, as well.

In the court case, which was brought by eight Buffalo homeowners, the Appellate Division overruled an earlier State Supreme Court decision and ruled the city’s position on interior inspections violated the homeowners’ privacy rights, which are protected by the Fourth Amendment.

“There just seems to be an inconsistency with how they do their evaluations. They should be able to make an evaluation from the outside. It’s really an invasion of privacy, and it’s wrong for my house or any other house in the neighborhood,” said Runfola, a social sciences professor at Medaille College.

Initial assessments are based on a home’s exterior appearance and other factors, such as location, number of bedrooms and neighborhood home sales.

In 2009, Runfola’s two-story house, built in 1915, was assessed at $340,000. He maintains the four-bedroom house should have been valued at $210,000.

The eight homeowners in the appellate court case sought to lower their assessments by between $16,000 and $70,000.

The five-judge panel’s decision is a victory for fairness and constitutional rights, said Peter Weinmann, attorney for the homeowners.

“The city has dragged its heels on this for six years, trying to fight taxpayers seeking a fair tax assessment for their homes,” Weinmann said. “The city can still value a property, and determine the interior spaces, without exercising a full invasion of privacy.”

The city intends to appeal the decision to the Court of Appeals, the state’s highest court, said Joel Kurtzhalts, the special counsel who argued the city’s case.

It is necessary for an appraiser to enter a home to develop the level of detail needed to fairly and accurately assess its value, Kurtzhalts said.

“Our appraiser said it was important in determining market value to inspect both the interior and exterior, so we could tell the quality and condition of the property,” Kurtzhalts said. “He felt he would need to do so, so he wouldn’t be making too many guesses or speculating, and be more accurate than less.”

Broad impact

The appellate ruling doesn’t settle the homeowners’ assessment challenges against the city. But it does block city officials from using interior inspections as a way to justify what they think the assessments should be.

Most of the middle- and upper-middle-class homes involved in the legal challenge are located around Delaware and Elmwood avenues in Buffalo, on streets such as Highland, Lancaster and Lafayette avenues. Other homes are on Morris, Woodbridge and Depew avenues in North Buffalo, among other streets.

Weinmann said his suburban clients are fighting similar appraisal challenges and the appellate decision will affect them, as well. Those clients have homes in the towns of Amherst, Aurora, Clarence, Grand Island, Hamburg, Lockport and Orchard Park.

Typically, when a homeowner and a municipality’s assessor don’t agree on an assessed value, they compromise. But when a compromise can’t be reached – as happened in the city homeowners’ case – the homeowner and the city are required to procure their own appraisals.

That requirement brought about the Fourth Amendment issue.

The city insisted its appraiser have access to the inside of each of the homes to evaluate the properties, and that led to a years-long impasse as the case wound its way through the courts.

Supreme Court Justice Timothy J. Walker upheld the city’s position in 2013, ruling that appraisers had the right to go inside the houses. Homeowners who refused to let the appraisers inside would forfeit their right to appeal, Walker ruled.

The appeals judges sided with the homeowners in the Feb. 6 decision.

The city failed to show that its interest in interior inspections outweighed the homeowners’ Fourth Amendment right to privacy, the appellate court ruled.

The city assessment determines how much the homeowners pay in property taxes, based on the rate set by the Common Council.

Weinmann said many homeowners aren’t even aware when their assessments increase because the banks holding their mortgages typically pay the taxes.

But for some homeowners upset with their assessments, it’s financially worthwhile to hire a lawyer and seek legal help.

The city has no reason to send an appraiser into homes because all the information it needs can be found in its own files, Weinmann said.

“If there were any significant improvements, they would have been known to the city by virtue of the permit process. All the city has to do is consult its own records. There’s no need to go inside the house,” Weinmann said.

In addition, interior improvements are less of a factor in a home’s worth than is believed, he said.

“Improvements to an interior of a house have relatively little impact upon its value compared to overall size, location, numbers of bedrooms and bathrooms, and features,” he said. “If you have three or four bedrooms, or take the house and put it on the other side of Richmond, it will make an appreciable difference. But a granite counter top won’t make an appreciable difference.”

But John Zukowski, an independent appraiser hired by the city, said the interior condition of a home can make a difference, if, for instance, the kitchen or basement has been remodeled or, on the other end, if no major renovations or updates had been made for many years.

“Many new constructions have fully finished basements and they add value to the property,” he said. “Without inspecting a property, how would you know that? New kitchens – although the cost of putting one in may not equal the return you’ll get – still wind up adding value to the home. It’s whatever adds value. Otherwise, you’re basing the interior of the property on a set of assumptions that may or may not be correct,” Zukowski said.

Zukowski said what can be learned can go beyond what is on file with the city.

In his experience, the appraiser said, homeowners rarely turn down an appraiser asking to evaluate the inside of a house.

“Homeowners that generally don’t have a lot to hide don’t flinch at allowing us to inspect the property,” he said.

Still, Zukowski understands the reluctance to let the government into their homes.

“I see both sides,” he said. “Homeowners don’t want to be infringed upon. But at the same time the city just wants to do what’s right and make the information accurate.”

Clock’s ticking

Freedman, the Chatham Avenue homeowner, agrees with the notion that valuing real estate is an art, not a science.

The city assessed his two-story, three-bedroom home at $215,000. The assessment for the brick house, built in 1910, should be $40,000 lower, according to court papers.

“Years ago, when we started this, we compared our assessments with others around us, and it seemed like we were getting overassessed, and nothing has happened in the meantime to change that. Plus, there are some other things – like we’re the only ones in the vicinity who share a driveway and garage – which we feel should be taken into account,” Freedman said.

Freedman, an attorney, said he wouldn’t want city representatives going through his home.

“I wouldn’t be that excited about having that done unless they made that part of the system for everyone,” Freedman said. “It would have a chilling effect on property owners exercising their right to challenge property tax assessments.”

Meanwhile, Weinmann’s clients have paid taxes based on the higher assessments for each of the past six years. The cases will either continue to be litigated or be resolved through compromise.

Three of his clients have died since court action began, and others are anxious to reach a conclusion.

“I have an elderly client who wanted to have the case resolved so we don’t have to send her the refund check at Forest Lawn,” Weinmann said.

email: msommer@buffnews.com

repost from: http://www.buffalonews.com/city-region/citys-appraisers-dont-need-to-look-inside-houses-appellate-court-says-20150223

posted in Appraiser News | 0 Comments

Appraising Solar Energy’s Value – Solar Panels and Home Values

New research sponsored by the Department of Energy shows that buyers are willing to pay more for homes with rooftop solar panels — a finding that may strengthen the case for factoring the value of sustainable features into home appraisals.

The study, conducted by the Lawrence Berkeley National Laboratory in California, examined sales data for almost 23,000 homes in eight states from 2002 to 2013. About 4,000 of the homes had solar photovoltaic systems, all of them owned (as opposed to being financed through a lease with the solar company).

Researchers found that buyers were willing to pay a premium of $15,000 for a home with the average-size solar photovoltaic system (3.6 kilowatts, or 3,600 watts), compared with a similar home without one. Put another way, that translates to about four additional dollars per watt of solar power.

The study involved more solar property sales than previous research, making this sample particularly “robust,” said Sandra Adomatis, an appraiser in Punta Gorda, Fla., who is considered an expert in “green” valuation and is one of the study’s authors.

“This study is important for the buying public and the lending side,” Ms. Adomatis said, “and appraisers can say, here’s some proof there is some value to the system.”

More homeowners have been installing these systems as the cost of solar technology has dropped over the last decade. As of mid-2014, more than a half-million homes had solar systems, according to the report.

Real estate agents, appraisers and lenders are still trying to catch up with the technology, along with other energy-saving features, in terms of calculating their effect on home values — or lack thereof — in any given market.

Fannie Mae has acknowledged the growing proliferation of solar. In December, the government-sponsored institution issued a guideline specifying that if a house has an owned solar system, the appraiser should analyze the system and the market to see if it adds value.

The guideline provides “critical verbiage to give us some leverage” with lenders, said Gerard O’Connor, an appraiser in Lindenhurst, on Long Island, who has been trained in green valuation.

Long Island’s high electric costs have made it an attractive market for solar. About 40 percent of all systems installed in New York are on Long Island, according to the state’s Energy Research and Development Authority. Buyers are “certainly willing to pay more” for a house with the electric bills to prove the savings attached to its solar system, Mr. O’Connor said. But, he added, most lenders haven’t yet recognized that market shift.

Arthur Wilson, a builder developing five homes (all presold) with geothermal and solar panels in Middle Island on Long Island, has had his own issues with lenders. He said that an appraisal of $498,000 for the second house to be completed was recently “shot down” as too high by bank reviewers who he said were untrained in valuing green home features.

The lender asked Mr. O’Connor to look at the appraisal, and he said that he believed it was accurate in estimating the value of energy-saving features.

“Any new item or feature is always a nightmare in appraising,” Mr. O’Connor said.

He noted that, under the new Fannie Mae guideline, appraisers may not add value for leased solar systems, which are increasingly popular because they usually require no money upfront.

The Berkeley lab report notes that more research is needed into the effect of leased systems on home value.

http://mobile.nytimes.com/2015/02/22/realestate/solar-panels-and-home-values.html

posted in Appraiser News | 0 Comments

Mitchell Maxwell & Jackson sues state for allegedly destroying reputation

Appraisers had their licenses pulled, but judge later ruled that due process was violated

March 09, 2015 08:00AM

By Tess Hofmann

UPDATED, 9:49 p.m., March 9: Mitchell Maxwell & Jackson, the real estate appraisal firm that was dragged through protracted litigation for allegedly affixing false signatures to appraisal documents before being vindicated last year, is now saying the state owes them $10 million as compensation for the ordeal and the havoc it caused.

Co-founder Steven Knobel claims that the state’s case ravaged his company’s reputation and was responsible for driving away most of its clients, including its biggest, Citibank. While the firm was once worth $9 million and had 30 employees, the complaint states, it has now lost the majority of its business and is down to a single employee.

An investigation was opened into Knobel and MMJ co-founder Jeffrey Jackson in 2010 when Marianne Mueller, a former star employee who was later terminated, complained to the New York Department of State that her signature had been placed on appraisals that she had not reviewed, under the direction of Knobel.

At the end of 2012, an administrative judge for the New York State Department of State decided to revoke appraisal licenses, despite what the firm calls a dearth of evidence and a disproportionate reliance on the testimony of a “disgruntled former employee” who stood to benefit from discrediting the firm because she was seeking to get out of a noncompete agreement.

According to the complaint, filed Jan. 29 in the New York Court of Claims, Mueller’s testimony was changeable and unreliable. “The state ignored this inconsistency and knowingly relied on incredible, if not perjured, testimony,” the complaint states. Additionally, Knobel claims that the state ignored a parade of appraiser witnesses who refuted Mueller’s claims and even failed to grant MMJ due process, as the complaint they were presented with was inscrutable.

This argument ultimately prevailed last year when a State Supreme Court Justice found that due process was indeed violated and that the licenses should not have been revoked. The court stated, “There was a complete paucity of proof here that Knobel and Jackson individually or jointly were behind this so-called nefarious scheme.”

Though Knobel and Jackson were able to delay the revocation of their licenses pending their appeal of the decision the damage to the company’s name was irreversible, they claim.

In a phone interview with The Real Deal Monday evening, Knobel said there was a need for an ombudsman who could step in if the state failed to do its duty and carry out a fair investigation.

“If I wasn’t a very successful appraiser who had the resources to fight this, I would have given up on Day One,” he said.

At the market’s peak, MMJ was one of New York City’s most-dominant appraisal firms, with about 3,000 clients.

Now, Knobel wants retribution for the disproved accusation that unraveled a business he has run since 1991. “Knobel lost his salary, appraisal commissions, the value of his interest in MMJ and related entities, and his very livelihood,” according to the complaint.

A New York State representative declined to comment.

Hiten Samtani contributed reporting.

– See more at: http://therealdeal.com/blog/2015/03/09/mitchell-maxwell-jackson-sues-state-for-destroying-reputation/#sthash.H6sQujz0.dpuf?utm_source=NEWZ%3A%2F%2F%2FAppraiser+sues+NY+state%2FUSPAP%2FAQM%2FWarning+letters&utm_campaign=1223&utm_medium=email

posted in Appraiser News | 0 Comments

MetLife Home Loans to pay $123.5M in mortgage resolution

MetLife Home Loans to pay $123.5M in mortgage resolution

Admitted it knowingly made faulty mortgages

MetLife Home Loans agreed to pay $123.5 million to resolve allegations it knowingly made mortgages insured by the government that failed to meet federal underwriting standards, an article in The Wall Street Journal said.

The deal between the MetLife unit and the Justice Department involves loans insured by the U.S. Department of Housing and Urban Development’s Federal Housing Administration.

MetLife admitted as part of the settlement that its banking subsidiary had been aware that a substantial percentage of loans weren’t eligible for FHA mortgage insurance due to its own internal quality-control findings. These quality-control findings were routinely shared with MetLife Bank’s senior managers, including the chief executive officer and board of directors, the Justice Department said.

posted in Appraiser News | 0 Comments

Registration Opens for AI Annual Meeting

|

||

posted in Appraiser News | 0 Comments

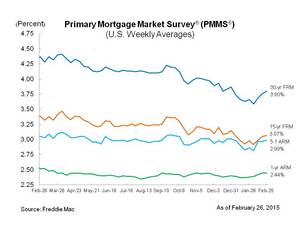

Mortgage Rates Rise for Third Consecutive Week

Mortgage Rates Rise for Third Consecutive Week

MCLEAN, VA–(Marketwired – Feb 26, 2015) – Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher amid solid housing data on new home sales and house price appreciation. Regardless, fixed-rate mortgages rates still remain near their late May, 2013 lows.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.80 percent with an average 0.6 point for the week ending February 26, 2015, up from last week when it averaged 3.76 percent. A year ago at this time, the 30-year FRM averaged 4.37 percent.

- 15-year FRM this week averaged 3.07 percent with an average 0.6 point, up from last week when it averaged 3.05 percent. A year ago at this time, the 15-year FRM averaged 3.39 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.99 percent this week with an average 0.5 point, up from last week when it averaged 2.97 percent. A year ago, the 5-year ARM averaged 3.05 percent.

- 1-year Treasury-indexed ARM averaged 2.44 percent this week with an average 0.4 point, down from last week when it averaged 2.45 percent. At this time last year, the 1-year ARM averaged 2.52 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for the Regional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quotes

Attributed to Len Kiefer, deputy chief economist, Freddie Mac.

“Mortgage rates rose for the third consecutive week in February following solid housing data. New home sales [PDF] beat market expectations at an annual pace of 481,000 units, down slightly from 482,000 units in December, but up 5.3 percent from a year ago. Also, the S&P/Case-Shiller National House Price Index [PDF] rose 4.6 percent over the 12-months ending in December 2014.”

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation’s residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is one of the largest sources of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blogFreddieMac.com/blog.

posted in Appraiser News | 0 Comments

Categories

- Appraisal Management Companies (52)

- Appraisal Process Training (14)

- Appraiser Jobs (24)

- Appraiser Marketing (69)

- Appraiser News (337)

- Appraiser News (9)

- Appraisers Directory (1)

- Become Appraiser (4)

- Blogroll (2)

- Dodd-Frank C&R Topics (28)

- Podcasts (13)

- Resources (2)

- State Licensing Boards (1)

- The Busy Appraiser Podcast (12)

Appraisal Management Company Directory

Now with 200+ AMCs listed

Top 46 companies list send me 90% of all my AMC work.

Order Today!

Non-Lender Marketing Guide

NEW Appraiser Marketing Guide and List of 11,000+ Direct Lenders, Credit Unions and Bail Bond Companies

Order Today!

Get them both together and SAVE!

|

|

|

|

Buy Guides Here

No More Middlemen & AMC Directory

Get both Directories and we will even throw in a copy of the Maximizing AMC Orders and Income eBook for free! Significantly Discounted and on SALE right now. Original Cost for all 3 = $184.95 Price: $144.95 - Electronic Versions Only

Appraisal Management Company Directory

and additional chapters on recession proofing your appraisal business, getting more estate appraisal requests and search engine marketing. First 37 on the list send the most work, First 10 on the list are currently my BEST clients.

Non-Lender Marketing Guide & Spreadsheets

Appraiser Marketing Guide and List of 11,000+ Direct Lenders, Credit Unions and Bail Bond Companies. Get off the AMC roller coaster ride for good!

Latest Posts

- Appraising Short Term Rentals

- Appraiser Job in Baltimore, MD

- Appraisal Orders : Coming soon in 2024!

- Happy Holidays!

- HUD Appraiser – Job Baltimore, MD Boston, MA New York, NY

- Getting more appraisal work with Yelp reviews

- Real Estate Appraiser Jobs with the Internal Revenue Service

- 2023 Appraisal Management Company Directory NOW AVAILABLE

- Review Appraiser Jobs with HUD

- Lead Appraiser Jobs with Dept of the Treasury